We looked at the stages of how to buy a house in this post; now it’s time to get acquainted with the property professionals who are available to help you.

Let’s untangle who does what in the property industry, and more importantly, who you should connect with.

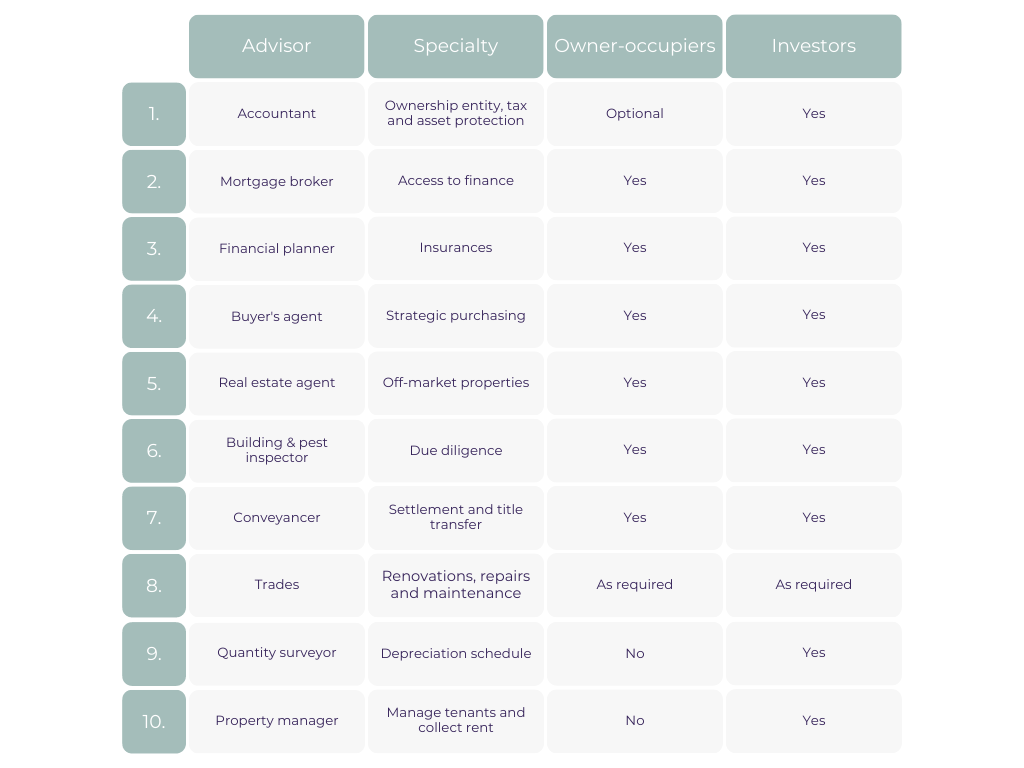

Note: your needs will depend on whether you’re an investor or an owner-occupier. Investors tend to need more advisers than owner-occupiers (more on that below). Now, let’s walk through the key stages of purchasing property and ‘meet’ the professionals you might encounter along the way.

Key stages of buying property

- Securing finance (getting a loan)

- Finding a property

- Performing due diligence (checking the property’s condition)

- Completing the purchase transaction

- Improvements and leasing

Stage 1: Securing finance (getting a loan)

When it comes to financing property there are 3 main professions you should talk to.

Accountant

Do you need an accountant to buy a house?

As an investor, your accountant is the first person to call if you’re thinking about buying property.

Accountants are the experts when it comes to figuring out how to legally minimise your tax. How’s your knowledge of the Income Tax Assessment Act? …exactly. A good accountant will be able to explain the different entities (or, structures) available to you for purchasing property in a way that can minimise your tax. You can invest in property in your own name, in a trust or through a company. Your accountant will be able to compare and contrast the benefits and limitations of each option. Just remember, you’ll need to decide on your purchasing entity before you make the purchase.

For owner-occupiers, accountants can discuss the various asset protection methods. This is worth considering for people who have a high profile or who work in highly litigious industries (such as doctors) where you’d want to ensure your home is not at risk.

Mortgage broker

*Disclaimer* this section has been written by a mortgage broker 😊

Do you need a mortgage brokerto get a home loan?

Bias aside, mortgage brokers are highly valuable when it comes to purchasing property. Whilst you can go directly to a bank instead of using a broker, in doing so you could be cutting off your best loan options.

Mortgage brokers are like home loan matchmakers. They’ll research loan options from across their lending panel (to give you an idea, we have access to 30+ lenders) to suit your individual circumstances, negotiate your interest rate, and take care of all the paperwork and the application process.

And how much would you pay for this service? $1,000? $2,000? $5,000? Try $0. That’s right – most mortgage brokers don’t charge fees to their clients, because they receive a commission from the bank after you take out the loan they’ve arranged on your behalf.

It’s worth noting that brokers are required to adhere to Best Interests Duty (BID) legislation, meaning they’re legally required to act in your best interest, not their own. The reality is that BID doesn’t apply to bank branches or online banks, and they will simply try to fit you into whatever they have available from their own bank.

Every bank has their own policies and loan offers, so, unless you’re prepared to do all the comparison legwork yourself before approaching a bank (who may very well decline your application), why wouldn’t you get a broker to do the work for you? Your broker can help you minimise interest, minimise fees, maximise your borrowing power and structure your loans in the most appropriate way to achieve your goals. Furthermore, a good broker will check up on things annually and make sure you’re still on a good rate (you won’t get this service from a bank).

‘It’s a good idea to speak with a mortgage broker or home loan specialist early in the process to ensure you have realistic expectations of how much you can afford to borrow and what products are most suitable to your circumstances.’

– Macquarie Bank

To learn more about why you should use a mortgage broker, take a look at our previous blog post.

Financial planner

Should you use a financial planner to buy a house?

Financial planners are professionals who can help you plan for and manage big financial decisions. They can prepare personalised strategies based on your goals and current financial situation. Their advice may cover budgeting and saving for a deposit, investing, superannuation, insurance, taxation, and planning for retirement.

Borrowing large sums of money to purchase or invest in property can be risky, but with good financial advice you can mitigate that risk by ensuring you have emergency funds, good cashflow management and the right insurance.

Perhaps the main reason to talk with a financial planner when buying property is to get your insurances right. Financial planners can advise on the insurances available to protect your assets, to ensure you can meet future payments in the event of job loss, accident, injury, or death. With a holistic view of your financial affairs, they’ll be able to advise the most beneficial way for you to pay for your insurances too; for example, within your superannuation instead of paying out of pocket.

Do you need a financial planner to buy a house, or can you manage your assets yourself? You can go it alone, but anyone can benefit from the knowledge of a professional financial planner, especially those who have a number of assets. It’s wise to seek out a financial planner to ensure your insurances are in order and to give you peace of mind that your largest assets are protected.

Stage 2: Finding a property

At last – the fun part – looking for a property! Although you might think this is a job just for you, there are industry professionals who can present you with options and help you make decisions. So, while the obvious starting points for looking at property are the major listing sites realestate.com.au and domain.com.au, a buyer’s agent and your local real estate agents can also help.

Buyer’s agent

What does a buyer’s agent do?

You hire a buyer’s agent (aka buyer’s advocate) to research properties, present you with options and negotiate with real estate agents on your behalf. This type of advisory service has been available in Australia for over 20 years, but many buyers are either unaware of its existence or may prefer to do the task themselves. In contrast, in the United States, it’s considered the exception rather than the rule to buy property without a buyer’s agent.

Who pays the buyer’s agent, you may be wondering? That would be you, the buyer. In Australia, buyer’s agents usually charge between 1% and 3% of the final purchase price. This seems like a lot, so why use a buyer’s agent? Buyer’s agents know how to get the best outcomes for their clients by negotiating with real estate agents and even bidding at auctions.

Buyer’s agents are skilled at local market research for both owner-occupier clients and investor clients. You can provide them with a brief of what you’re looking for, where you’d like to buy, and how much you’d like to pay. Your agent will then review what’s available publicly, and work with real estate partners to explore any off-market properties they have access to. [Side note: off-market properties are those that aren’t officially for sale yet and haven’t been listed on the major searching portals.]

If you’re investing with the assistance of a buyer’s agent, they may recommend locations to purchase based on rental yield and capital growth outlooks, so it’s likely they’ll present you with some options you wouldn’t have considered yourself.

One last thing to note: a buyer’s agent DOES NOT have a list of properties just waiting for you to buy. They’ll work with you to find a property from scratch. If someone is calling themselves a buyer’s agent and wants to show you properties off the plan (meaning, a property that hasn’t yet been built), they’re probably working with the developer and getting a commission that will be built into your purchase price.

If you opt to use a buyer’s agent, it’s best to find an independent, qualified and experienced adviser who comes highly recommended.

Real estate agent

What can real estate agents do for buyers?

Yes, real estate agents work on behalf of the seller, not the buyer, but remember, they’re in the business of selling houses, so if you can connect with a few agents in the area you’re looking to buy and tell them exactly what you’re looking for, and that you have your finance ready (through a pre-approved loan) they’re going to remember you when something comes across their desk that fits your brief.

When you’re buying property, real estate agents can be extremely helpful in your search and decision-making. They can help you understand sales in the area and the level of interest in certain types of properties. They can also give you information about suburb features and demographics. So, although you don’t need to connect with a real estate agent in order to buy property, they can be a useful resource.

Stage 3: Performing due diligence (checking the condition of the property)

When you find a house you’re interested in buying you’ll want to become fully aware of its condition. You’ll need to understand if there are any building issues that will need repair or replacement. You’ll also want to find out if there have been, any nasty critters living in the home before you. Enter: the inspector.

Building and pest inspector

Do you need a building inspection when buying a house?

Absolutely – yes. Building and pest inspectors (usually the same person performs this whole job) will check over the house to ensure there are no bad surprises in the place you’re looking to buy. With many houses being professionally styled prior to sale these days, it can be easy to forget there’s a complex building structure behind a carefully curated façade. The last thing you want is to discover you’ve bought a house in need of significant repairs.

Building and pest inspectors will crawl all over the house (literally) to ensure it’s been built to the National Construction Code and relevant Australian standards. They’ll report on its current condition, as well as identify the presence of any pests like termites and borers. By employing the services of a building and pest inspector you’ll get a level of confidence that the house you want to buy is in good shape.

There can be serious (and expensive) repercussions for buying a house that has pest damage or other underlying building issues, so the cost of a building and pest inspection is a small price to pay for peace of mind. If the inspection reveals some nasties, you may even be able to use the report as a negotiating tool when submitting your offer to purchase. Say the report comes back with an underlying structural issue that could cost $20,000 to repair – you could factor this into your offer by either requesting it be repaired prior to sale, or by making a lower purchase price offer.

For those looking to purchase in a strata scheme (such as a unit within a block of units), it’s also a good idea to get a strata report so you can see a summary of the strata financial accounts and if there are any levies on the horizon for any major works due to be undertaken. For example, all owners may need to contribute additional funds to fix a broken elevator. If there are any levies coming up, it doesn’t mean you can’t buy the property, simply that you need to factor in these additional costs before you make an offer so that you know you can still afford to purchase it.

Stage 4: Completing the purchase transaction

Time to sign on the dotted line and get some keys!

But, before you *actually* sign anything, it’s best to have your contract checked over by a professional.

Conveyancer

Do you need a conveyancer before making an offer on a house?

Yes. Unless you have expertise in this area, you’ll need a conveyancer.

What does a conveyancer do? Conveyancers are the go-to professionals for contract reviews of any houses you’re looking to purchase. If there are any clauses in the contract that are unfavourable to you as the purchaser (for example, if a cooling-off period has not been allowed, or if damaged property is not being fixed) your conveyancer can advise on how to negotiate the terms of the contract.

Speaking as a mortgage broker, it’s always a good idea to have your conveyancer include a ‘Subject to finance’ clause in the contract. A finance clause allows you to withdraw your offer without losing your full deposit if you’re unable to get a loan approved within the stated period of time (for example, 14 days).

Once you’re happy with the contract and you’ve signed it and exchanged with the vendor, your conveyancer will arrange everything for the settlement process including conducting title checks and searches on the property, and transferring the property over to your name. Conveyancers can also assist with applying for government grants and exemptions (such as the first home buyers’ stamp duty exemption), where applicable.

Your conveyancer will talk to you about where to transfer your deposit before settlement (commonly it will go to the conveyancer’s trust account for safe keeping). This will ensure that all of the funds required to complete the purchase are ready before the actual settlement date. If the money isn’t ready, it will delay settlement and you could be liable for costs incurred by the seller.

Note: Solicitors can offer conveyancing services, but they might not specialise in property transactions. Conveyancers specialise in property law and are typically a more economical choice for most property buyers. Just remember, property laws are state-based laws, so make sure you find a conveyancer who is fully licensed in the state you want to purchase in.

Beware of scams

Just a word of advice about transferring your deposit for settlement (or any other large money transfers for that matter). It’s always a good idea to get direct confirmation from your conveyancer of their correct bank account details. Do this either face to face or over the phone by phoning them directly.

Unfortunately, there have been instances of cyber-security breaches where emails have been hacked and bank account details changed; the house buyer unknowingly then sends their deposit to the fraudulent bank account and there’s little chance of ever getting it back. Sad but true. So, stay one step ahead of the hackers and make the phone call to your conveyancer to confirm all the details are correct before sending any money.

Stage 5: Improvements and leasing

Once you’re a property owner, and depending on whether you plan to live in the house or rent it out, there’s a whole bevy of professionals you should get acquainted with.

Tradespeople – builders, plumbers, electricians

The best time to get the trades into your new property is before you get into your new property. If you want to get a new kitchen or bathroom, or even just fresh carpet or paint, give serious consideration to getting this all done before you move in. Anyone who’s lived on-site during a reno will tell you what a headache it is!

This point is even more critical if you’re an investor – have trades finish any property updates before you rent out the property so you can advertise a recently renovated rental and minimise any rental downtime in the future.

Quantity surveyor

What does a quantity surveyor do?

This one is just for the investors. A quantity surveyor is responsible for estimating how much it originally cost to build your property – this allows them to generate a ‘depreciation schedule’. A depreciation schedule lists out allowable tax deductions from your investment property over the course of 40 years.

Without a schedule in place, you could be missing out on potentially tens of thousands of dollars in tax breaks over the course of your property ownership. The initial investment for a depreciation schedule (roughly $800) can usually be recouped in the first year of ownership alone. This is because quantity surveyors are the experts when it comes to knowing what can be depreciated, and for how much. You can then give the depreciation schedule to your accountant and when it’s time to prepare your tax return they’ll include the depreciable amounts, which ultimately reduces your tax liability – totally worth it!

Property manager

Again, this is another one just for the investors. Where do we stand when it comes to property managers vs self-management of your investment property? Without a doubt – when it comes to renting out your investment – it’s best to outsource to a licensed and qualified property manager.

Yes, you could take on this job yourself, but you’ll be spared a lot of hassle if you let the professionals do it. You’ll pay them a small monthly fee that’s taken straight out of the rent, and they’ll look after:

- Advertising your property

- Conducting ‘open for inspections’

- Reviewing prospective tenant applications and making recommendations to you

- Preparing lease agreements

- Paying your council, water and strata rates from rent payments

- Routinely inspecting your property to ensure the tenants are taking proper care of it

- Arranging repairs or maintenance required at the property

- Giving you rental appraisals so you can optimise the rental income from your property

- Managing any disputes that may arise during a tenancy.

If you’re looking to save yourself time, stress, and annoying phone calls from tenants, be sure to use a property manager when renting out your investment.

Summary

There’s so much to consider when buying a property, but with your own team of qualified professionals to assist, it’s much easier to make your property ownership goals a reality. There’s absolutely no doubt that it’s worthwhile to invest in professional services so you can avoid unnecessary drama and ensure the whole process ticks along smoothly.

Here’s a recap of the property professionals you should consider talking to:

If you need any assistance from a mortgage broker with financing your next purchase, book a time directly in my calendar to see how I can help. Tweed Coast Home Loans is based locally but works with clients Australia-wide. Finally, if you need advice from any of the other professionals on this list, we’d be more than happy to connect you with our trusted partners.