If you’re a first home buyer, chances are you’re also looking for your first home loan. Many first home buyers can find the process daunting, but it doesn’t need to be. With some practical advice and help along the way, you’ll find the home loan that’s best for you. More importantly, you’ll move closer towards buying your first home.

In this blog I’m going to share the most important things you should know before you borrow. Here’s what we’ll cover:

- Saving for a house deposit

- Why it’s best to use a mortgage broker to get a home loan

- Knowing how much you can afford to borrow

- Finding your home

- Understanding different types of mortgages

- Borrowing from the Bank of Mum & Dad

- Renting out your first home

- First home buyers grants and other incentives.

SAVING FOR A HOUSE DEPOSIT

Wondering how much house deposit you’ll need in Australia? Most lenders require a deposit of at least 10–20% of the total home loan amount. For a run-down on the process of buying a home, including when your house deposit needs to be paid, check out our FAQ.

You’ll also need to cover the cost of Lenders’ Mortgage Insurance (LMI) if your loan amount is more than 80% of the value of the property. Ideally, you should start with a 20% deposit to avoid paying LMI.

What is Lender’s Mortgage Insurance?

LMI is a one-off insurance payment charged by lenders to those borrowers who are considered a higher financial risk. Your risk is determined by your loan-to-value ratio (LVR), which is the amount you want to borrow divided by the lender’s valuation of the property you want to buy.

Lenders generally like to have at least a 20% buffer in case you have to default on the loan (can’t make your mortgage repayments). In this case, the lender stands a good chance of recouping the loan amount through the sale of your property.

Although LMI can add several thousand dollars to property purchase costs, many first home buyers consider it a worthy investment. LMI helps secure a loan with a lower deposit, meaning you can own a property sooner than if you had to save the full 20%.

The critical factor is whether your income can support the higher loan repayments. As a broker, we can give you an LMI estimate based on your financial situation before deciding how much you need for your deposit. Feel free to book a 15-minute consultation when you’re ready.

When’s the best time to start saving for a house deposit?

There’s no time like the present to start stashing cash for a house deposit. The longer you put it off, the harder it can be to develop good savings habits.

Unless you win the lottery, inherit, or receive some other windfall, chances are you’ll need to make sacrifices to save. This may mean finding cheaper rent or moving back in with parents, while making some tough choices about how you spend your disposable income.

Start with a budget. Make an honest appraisal of all of your living expenses and decide where you can cut back.

Where should you save your house deposit?

Once you know how much you can save, set up a direct deposit from your pay into a separate savings account. Think of it like paying yourself first. Make sure the account has no card access so you’re not tempted to spend the money.

It may not be easy, but it will be satisfying to watch your nest egg grow, knowing you’ll eventually reap financial rewards.

use a mortgage broker to get a home loan

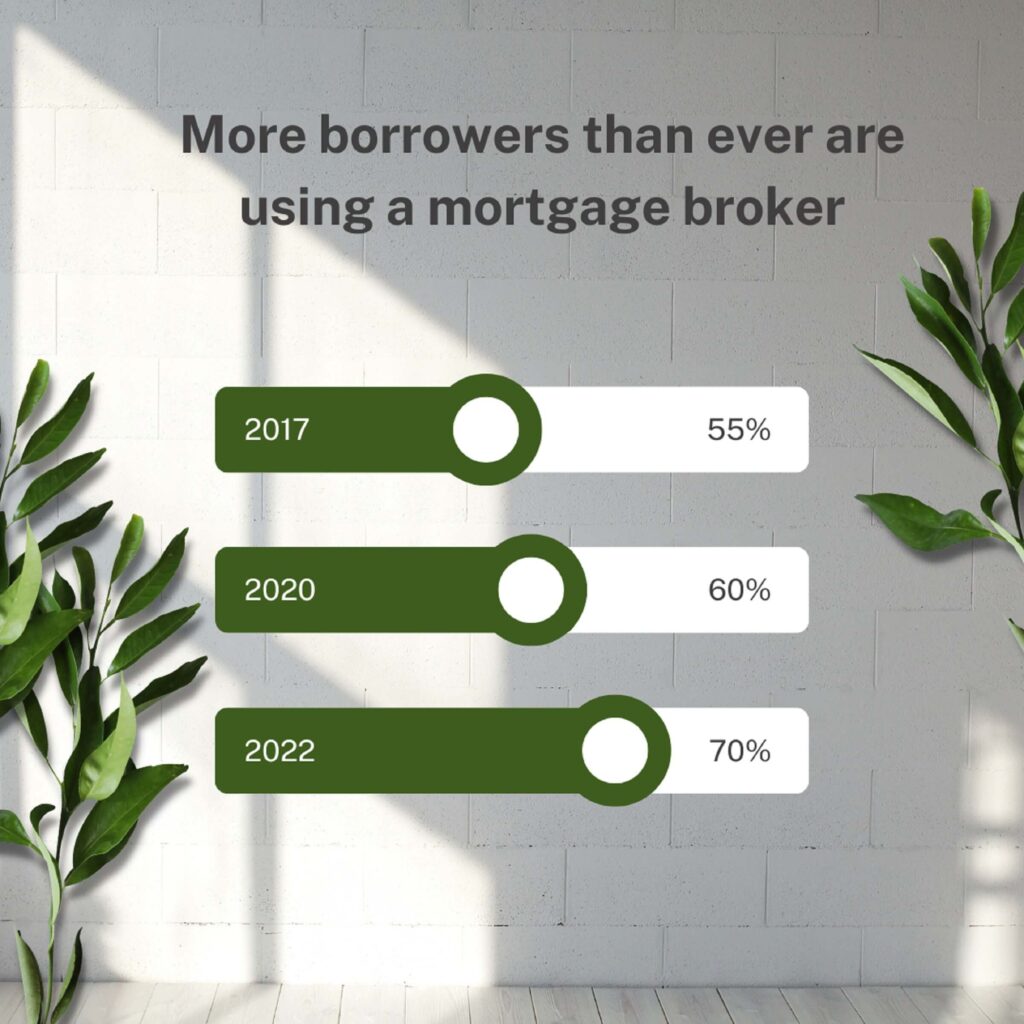

More than 70% of all Australians taking out a mortgage are doing so with the help of a mortgage broker. It’s the smart way to go. Home loans can be complex and there are many variables to factor in. A mortgage broker removes the major hassle of you having to do all your own research, comparisons and applications. Plus, it doesn’t cost you anything extra to use a mortgage broker (brokers are paid a commission from the lender.)

As a broker servicing Australia-wide, I’d be happy to talk with you about what you need to consider when it comes to your first home loan.

Benefits of using a mortgage broker for your home loan

- Mortgage brokers find and recommend loans to suit your personal circumstances

- Mortgage brokers work with multiple lenders, not just one

- Mortgage brokers can often negotiate a better outcome

- Mortgage brokers do all the tedious loan legwork for you

- Mortgage brokers aim to save you time and stress, and get things moving as quickly as possible.

Why use a mortgage broker?

When it comes to buying your first home it’s wise to speak to a mortgage broker early on – months before you’re ready to buy.

Not only is a mortgage broker a wealth of information, they’ll also help you find the right loan, and aim to make the whole application and approval process much easier.

If you choose to work with Tweed Coast Home Loans as your mortgage broker, the first thing we’ll do is catch up and chat about your needs and goals. We can then give you a realistic idea of your borrowing potential. We then move on to finding the home loan that suits you best. A pre-approved home loan is a great idea because it means when you find the right place, we can sort out your finance as quickly as possible.

There are literally hundreds of different loan products for you to choose from – it’s just a matter of using our expertise to help you find the right option.

As your mortgage broker, we have access to 40 different lenders and an array of different loan products. We stay up-to-date with changes within the market and new products from lenders as they come online.

We’ll work with you to give you the peace of mind that you’re making the right decisions towards a comfortable lifestyle.

Once you’ve found your house, and have chosen a home loan, we take care of the home loan application process.

Why not go straight to a bank?

Of course, you could walk straight into your local bank branch to get a home loan, but that option is trickier than it sounds.

Firstly, which home loan options do you choose? Do your circumstances fit the bank’s lending policy? And, what about the other lenders, building societies and credit unions – how do you know you’ve chosen the lender with the best options for you?! Are you going to compare them all yourself?! Beware of online loan comparison tools, too. They might be able to tell you some of the options available, but NOT all. On the flip side, brokers have access to some unadvertised lenders and rates. But more to the point: there’s no way for you to know which would actually lend to you. You’d have to apply to each one to find out – who has the time?! A broker takes care of all that on your behalf.

Brokers work for you, not banks

A mortgage broker doesn’t just have a handful of loan options, like a bank. We use specialist software and have access to hundreds of loan options from multiple lenders.

Australia is indeed the lucky country. We’re blessed for choice when it comes to the amount of competition that exists in the mortgage market. With so many lenders, and so many products under each of their brands, it’s important you make the most of this choice regardingwhat you choose when it comes to your home loan.

There are a lot of options out there, and with regularly moving interest rates, new products, and promotions, it’s an ever-changing market. And let’s not forget that if you’re a first home buyer, you’re probably very new to this. That’s why a broker makes sense. We do this every day; we know the lenders, their products and policies and we keep up to date with changes. We’re here to help choose what’s right for you, and filter out what’s not.

Banks enjoy working with brokers, as we do a lot of the banks’ work for them and make their jobs much easier. We help speed up the application process and get you the top-notch customer service you deserve.

Having a broker in your corner makes finding the right loan easier and can save you time and, hopefully, money.

How much can you afford to borrow?

When you’re starting to think about buying a home, the first thing to do is work out your borrowing potential.

You may have a dream home in mind but first you need to know if you can afford it. There are many factors that will influence your decision around what to buy and where. This might include proximity to work and family, and your stage of life, to name a few. However, the single biggest decider is nearly always what you can afford.

It’s really a case of looking at the big picture and working your way back from there. Consider your household income and what you realistically can afford in loan repayments, taking into account all of your expenses.

As a guide, using a mortgage calculator can be a great place to start. But be mindful that online calculators can’t factor in your personal circumstances, or your eligibility for a loan. A mortgage broker can give you a much more accurate idea of what you can afford. Then when you’re ready, we can look to obtain a pre-approved home loan so you can put an offer on a home as soon as you find the right one.

Finding your first home

When you know what you can afford, you’ll have a much better idea of what type of home you can buy and where you can live.

When it comes to the type of property and location, many first home buyers find they have to compromise. A free-standing home in an established, convenient, leafy neighbourhood near a CBD, with great transport and near family and friends might be out of reach the first time around.

If convenience is important, you may be looking at apartments instead of houses. Keep in mind that often the closer you get to a CBD, the higher the demand and price. Your budget might only stretch as far as an older unit if you want a property close to a major city.

If you definitely want a house, depending on your location, you may be restricted to the outer suburbs or regional areas. Alternatively, a townhouse closer to the city centre could offer the compromise you’re looking for between size and price.

You should consider what’s most important to you now and over the next five years. Are you looking to be part of a community that’s similar in age to you? Is it important to get to and from work as quickly as possible or can you cope with a long commute, providing you have a great lifestyle when you get home? Do you have children or are you starting a family? All of these, in addition to your budget, will influence where and what you buy.

Research is essential

Do your homework on suburb demographics and price trends over the past 10 years. Also look at existing and planned infrastructure, such as public transport, shopping centres and schools. If property values in one suburb have really taken off in the past 5 years, find out why; consider whether neighbouring areas have similar potential.

types of mortgages

There’s a lot more to home loans than interest rates and fees.

Obviously, a low rate is important but it’s not everything. There are different sorts of loans and features that will make managing your mortgage easier. As your mortgage broker, we can advise you on the fundamentals you need to know to make an informed decision. To begin with, it’s important to know the main types of loans:

VARIABLE LOAN

Interest rates go up and down depending on factors such as the official cash rate, market conditions and each lender’s decisioning. When the rate goes down, so do your minimum repayments. But when the rate goes up, your payments will too.

FIXED RATE LOAN

The interest rate can be fixed for 1 to 5 years. Even if rates change, your repayments stay the same. This helps manage your household budget by knowing exactly what you’ll have to pay. Of course, you won’t benefit if interest rates drop. There also may be significant break costs if you want to change the loan before the end of the fixed term. This type of loan is great for people who want to know exactly what they’ll pay each month regardless of what’s happening in the economy.

SPLIT RATE LOAN

One part is variable, the other is fixed. This lets you enjoy the benefits of an interest rate drop but also protects you from being affected fully if they rise. It’s up to you to decide how much of your home loan you fix and how much you leave variable.

INTEREST ONLY LOAN

You only pay the interest on your home loan but not the principal loan amount. (A ‘standard’ loan would have principal and interest repayments, allowing you to pay down the loan with each repayment) . With interest only loans your repayments are less than principal and interest repayments, but you still have the same level of debt at the end of the interest only period (typically 1 to 5 years). Despite the lower monthly costs, an interest only loan will usually cost more over the term of the loan because you won’t start paying off the principal until after the end of the interest only period .

LINE OF CREDIT

You can pay into and withdraw from this account as long as you keep up with the required repayments. You can have your income paid into this account to help pay off the mortgage sooner but interest rates are usually slightly higher.

HONEYMOON PERIODS

Designed especially for first home buyers, a ‘honeymoon period’ means you can enjoy a lower interest rate for the first 6 to 12 months. After that period the rate returns to the standard variable rate.

LOW DOC

These are popular with self-employed people because they need less documentation or proof of income. However, they usually have a higher rate of interest or need a larger deposit, or both.

Borrowing from the bank of mum & dad

With property affordability getting increasingly tricky, many first home buyers are reaching out to their families for financial assistance to help increase their borrowing power.

Borrowing money from your parents to buy a house can reduce the financial burden. It may mean you can afford a better quality property with greater growth potential than if you bought solo. But it’s not a move you should make lightly. Even if you decide to buy your first property with family, make sure you seek legal advice and ensure each party understands their financial and legal obligations. You don’t want a financial transaction or financial partnership to come between you and your family.

The most common way people get assistance from their parents is through a family guarantee. This guarantor scenario is useful where the first home buyer can afford the repayments for a loan above 80% LVR (loan to value ratio), but where they haven’t yet saved enough of a deposit to cover 20% of the purchase price plus purchasing costs.

Borrowing money from family means you can buy a property sooner, even if you don’t have the whole deposit yourself.

Over time as you pay down the loan and (hopefully) your property increases in value, the LVR will reduce to a point where it’s below 80%. When this happens, the guarantors can be removed from the loan.

If you’re considering this option you may find it helpful to speak to a financial planner and lawyer. There are potential benefits but as with every significant financial decision you make, it’s critical to weigh up the risks at the same time.

Rent out your first home

There’s no rule that says you have to live in your first property.

Many first home buyers are challenging convention by ‘rentvesting’. What is rentvesting?! It’s renting where you want to live, and buying an investment property in a more affordable location.

The objective for these renters is to buy where they can afford to get a foothold on the property ladder. That could be another suburb in the same city or a town in an entirely different state.

As with any investment, the key is to choose a property on financial merit, not emotion. Are you looking for capital gain over time or high rental yields right away? The investment property can be positively geared, where the rent exceeds the cost of the mortgage and upkeep to give you a profit; or negatively geared, where the rental income is less than the cost of owning and managing the property, which may create a tax deduction.

Again, it’s important to seek appropriate legal and financial advice so you’re well informed about how renting and taking on an investment property impacts your finances and tax obligations.

The first home buyers grant and other incentives

The First Home Owners Grant and other grants and stamp duty concessions may be available to give first home buyers a leg up.

The grants usually apply to land or property up to a certain value. These thresholds can vary depending on the type of dwelling, whether it’s new or existing, and the state or territory in which the property is located. The savings can be significant. So, it’s certainly worth exploring.

Visit www.firsthome.gov.au to find out what’s on offer under the FHOG scheme in your market.

It’s also worth checking if your state or territory offers stamp duty exemptions or concessions if you’re a first home buyer. Are you located in NSW? Check our our blog covering changes to the first home buyers schemes as of 1 July 2023.

Government guarantees for first home buyers

The federal government also offers support by way of the Home Guarantee Scheme (HGS).

Under the scheme, eligible purchasers can buy a home with a deposit of less than 20% and won’t have to pay Lenders Mortgage Insurance (LMI).

So for example, if a first home buyer wanted a house priced at $600,000 they’d ordinarily need to save $120,000 as a deposit to avoid paying LMI. Under the HGS, eligible purchasers could save as little as $30,000 (5% deposit) and not pay any LMI. This is an upfront saving of ~$24,000 in LMI and $90,000 of reduced savings required! Not to mention saving the time it would usually take to actually accumulate those extra savings.

There are 3 variations of the HGS:

- First Home Guarantee (FHBG)

- Regional First Home Buyer Guarantee (RFHBG), and

- Family Home Guarantee (FHG)

| FHBG | RFHBG | FHG | |

| Places | 35,000 | 10,000 | 5,000 |

| Deposit | 5% | 5% | 2% |

| Eligibility | First home buyer (or haven’t owned for 10 years) [Note 1] | First home buyer (or haven’t owned for 10 years) [Note 1] | Single parents or guardians who don’t currently own |

| Residency [Note 2] | Citizens and permanent residents | Citizens and permanent residents | Citizens and permanent residents |

| Location | All Australia | Regional only [Note 3] | All Australia |

| Price caps [Note 4] | Same for all guarantees | Same for all guarantees | Same for all guarantees |

Notes:

- Individual or joint applicants allowable. Joint applicants may include partners, friends, siblings and other family members.

- Permanent residents doesn’t include NZ citizens living in Australia.

- Must have lived in the regional area for the preceding 12-month period. Some exemptions may apply for employees required to relocate for work.

- Price caps vary between capital cities and regional areas, and from state to state. Official price caps available here.

Wrap up

As you can see, it make sense for first home buytyersto talk to a mortgage broker, rather than trying to figure out all the intricacies of multiple banks’ products and lending policies.

If you’re ready to learn more about how much you can borrow for your first home, here are three ways to connect with Tweed Coast Home Loans (servicing Australia-wide):

- Book your initial consultation with Lindsay, here (no fees)

- Subscribe to our newsletter for more information and articles like this one (check the footer); and

- Connect with us on Instagram and Facebook.

Legal stuff

Please note, as mortgage brokers we don’t provide tax, legal or accounting advice. This blog has been written for general informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. We encourage you to consult your own tax, legal and accounting advisers before engaging in any transaction.