Guest blogger Alex Olsen is the other half of mortgage broker Lindsay Olsen of Tweed Coast Home Loans. Alex is a mum of 3, money–saving enthusiast, and freelance copy editor.

Last month we looked at How to Make a Budget that Actually Sticks – a worthwhile skill if you’re saving money to buy a house, or just living a little leaner.

We all know that budgeting can mean making sacrifices. That said, you can be crafty about how you spend your money so your life doesn’t feel lacking.

There are countless money-saving hacks to be found online. Below, I’m sharing my personal favourites to kick your savvy spending into gear.

Shop the big sales to save big bucks

The major retail sales events in Australia happen around New Years, mid-year (EOFY), Click Frenzy (end of October) and Black Friday/Cyber Monday (end of November). Write these down! You can save hundreds (maybe thousands) of dollars every year just by waiting to shop the sales. Rather than falling for instant gratification, hold off for the sales. I recently did a lot of Christmas shopping over the Black Friday/Cyber Monday weekend. I saved myself hundreds in that little stint alone.

Black Friday is a great time for a little wardrobe replenish, of course. The ladies will appreciate this one: I’d been eyeing off a dress for a month – it was $130 and I couldn’t justify the splurge on another ‘fun frock’. So I waited until Black Friday, and YAY – the dress came down to $65 on the seller site. But before clicking purchase I Googled and found it for 23 bucks on an outlet site! By waiting for the sales I bagged my $130 frock for $23. Score!

It’s a good idea to keep note about when your favourite shops they have their big sales. Stores typically run the same promotions year-to-year.

When it comes to shopping clothes online, I keep a wardrobe wish-list of pricier pieces, which I come back to when the sales are on. Yes, the items sometime sell out before the sales, but it’s a fun little fashion gamble because when you win!

Saving money with online grocery shopping

Buying groceries online is a great habit to get into for managing and saving money. In our household we have a separate bank account for our groceries. The grocery account gets automatically topped up with our budget each week. We usually opt for home delivery (amazingly easy, and free) or Click and Collect.

Shopping for your groceries online is easy and makes sticking to your budget easy. If you go over budget after you’ve added everything to your online trolley, you can make some changes (so long, Tim Tams) before you checkout. Compare this to shopping within the physical store, where the total amount at the checkout is a big surprise – and never a good one these days. It’s too easy to blow your budget in a supermarket.

Another great thing about buying groceries online is that you can see all the half-price specials with one click. By comparison, you’d miss a lot of the specials in store. I bulk-buy our staples when they’re on sale for half price. I save hundreds and hundreds of dollars by shopping like this. When shopping online, you can also filter the search results so the lowest price per unit items show first. This saves you standing in the supermarket aisle comparing 25 yellow tickets.

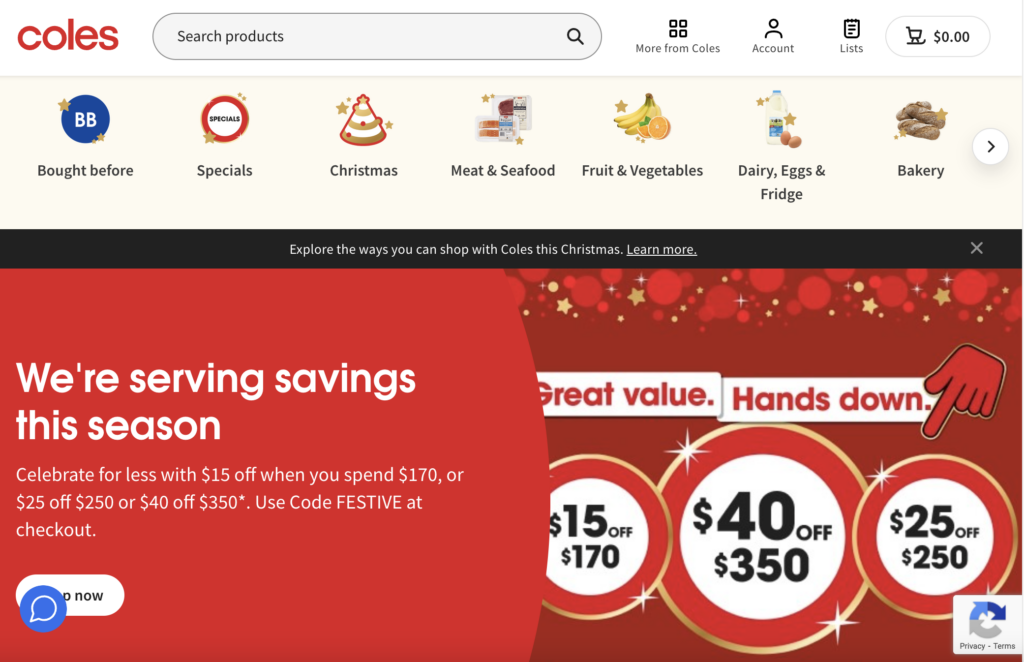

When you shop for groceries online you have access to coupon codes to take money off your shop. Often you can claim $20 off your shop once a month. Check out the money-saving Christmas codes from Coles, below – you won’t get those savings in store!

Of course, even with a weekly grocery shop we still need to dash to the shops a few times a week to restock bread and berries (if you know you know). I cap our online shop at a certain amount so we have enough money for those dashes to the shops.

Remember to make use of rewards programs such as Flybuys – you’d be crazy not to! You can scan your Flybuys card at Coles, Target, Bunnings, Kmart, and more. We earn at least $10 (up to $40) of Flybuys dollars every single week. We recoup that free money on dashes to the shops. #notsponsered

A final tip for grocery savings: skip the weekly shop every so often and use up whatever’s lurking in your cupboard or freezer (within reason, of course). You’ll be surprised how many meals you can pull together, and you’ll save a chunk on your groceries that week. This is a great tip to use a few weeks before Christmas because it means you’ll have extra cash (and cupboard space) to cover the festive feast.

Purposeful gifting

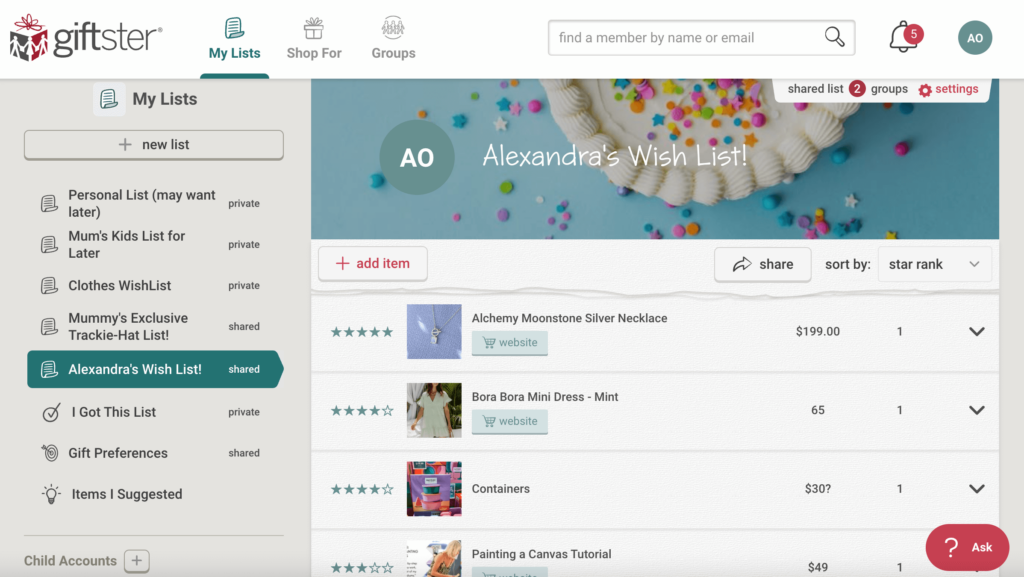

Using gifting wish lists within your family is a great money saving hack, as well as being great for the planet. Several years ago I introduced my entire family to Giftster, an online wish list platform, and we haven’t looked back. We each have a list where we add gift suggestions for our birthdays and Christmas. The platform also allows you to create lists on behalf of your children (although my teen-aged nieces are now old enough to create their own lists, which they love doing!). You can even add secret suggestions to others’ lists, for example, I can pop some things on my husband’s list that he can’t see, to give our extended family some suggestions if they need them.

We’re big on gifting in my family. I love giving and receiving presents that are surprises, bought from the heart, however, providing your loved ones with some pointers is great on a few levels. If someone is stuck for ideas on what to give, they can give you something that you actually want or need. And if you’re a gift recipient on a budget, you might get to unwrap something that you really want, but couldn’t justify spending the money on yourself.

Budgeting aside, I love how wish lists cut down on environmental wastage. We’re not giving and receiving things that aren’t going to be put to good use.

Lists can be incredibly useful for grandparents, especially as children grow older. Parents can give suggestions on what our kids would use, or what they need (which can helps parents financially, too).

Have fun for free!

FREE fun is always a winner, and if you’re in money-saving mode, you’ll definitely want to get acquainted with some free pastimes.

You might already be familiar with your local website for community events. Ours is What’s On Tweed but living on a border town, we also check in with Destination Gold Coast. These sites are great for finding free local events.

As a young family, a lot of our time is spent at beaches, parks and on local walks. Picnics are always fun, and catchups with friends can mean walks and get-togethers at home. Throw in the the occasional night out, of course (because life’s more fun when you have somewhere to show off your $23 frocks).

Holidays on a budget can mean camping, visiting with relos, or finding hidden gems on Airbnb or through travel deal sites. If you’re on a tight budget though, there’s nothing wrong with a staycation!

Saving money through pre-loved sales

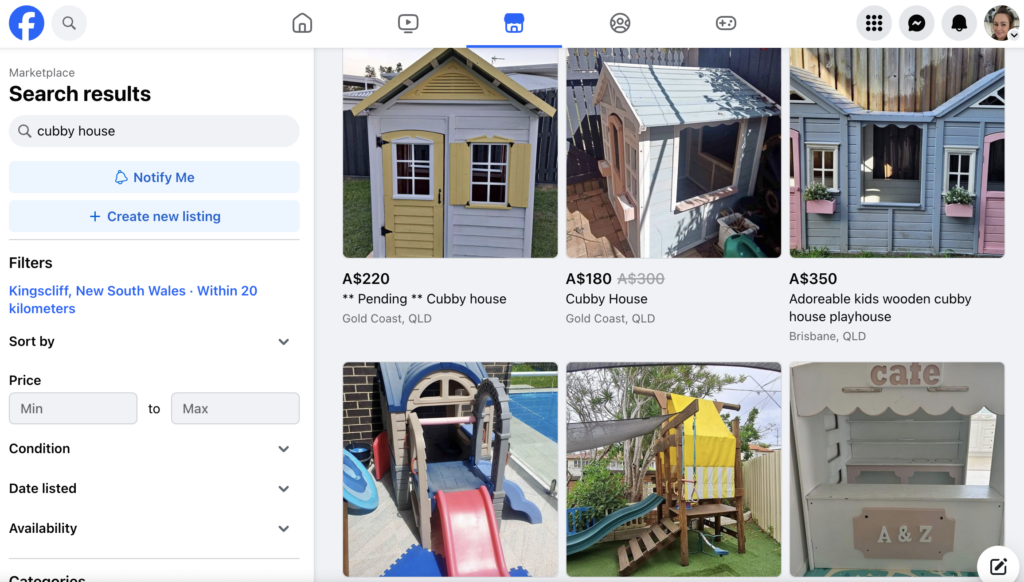

Buying and selling second-hand wares is one of the most rewarding money-saving habits to get into. Aren’t we blessed to have Facebook Marketplace?! Beats putting an ad in the paper to sell something secondhand! In the past, a lot of stuff would end up being donated or at the tip (which, speaking of free fun, was actually a pretty fun trip as a kid).

In any case, you weren’t making any money off your old stuff: these days, you can. And you should! Marketplace is doing great things to prolong the life out of our STUFF and prevent wastage. Whilst donating is fine too, Marketplace puts your wares in front of people who actually want and will use your stuff. Bravo Zuckerberg, you’ve done well there. (P.S. Does anyone use Gumtree anymore…?).

As well as selling bulky items on Marketplace (such as baby gear we no longer need) I sell small things too. I keep a stash aside in a basket and chuck them on Marketplace when I get the time. Even if you’re selling things for $5, the cash adds up. Plus you get the feel-good factor of knowing your pre-loved things are getting a second (or third) life). Last year I had a goal to save $500 from Marketplace sales to buy an appliance I had my eye on. It was so satisfying to hand over the cash when I reached my goal!

I’ve also had some great second-hand purchases, from quality outdoor furniture going cheap, to free plants, barely worn designer kids clothing and pre-loved toys, including a cubby house in good nick. When you give toys a good clean, toddlers don’t know the difference. I once salvaged a toy kitchen from a neighbour’s council clean-up pile and freshened it with paint – it’s still being used 4 years later.

Childrens books can be expensive and, whilst I do invest in the occasional book haul, we also love a freebie. As well as hitting up the library we also take advantage of the library ‘freebie’ shelf and preschool book swaps. Just this morning I switched 20 books that we’re a bit tired of in exchange for a pile of ‘new’ books that the kiddos are loving.

I hope these savvy savings tips have given you some inspiration for putting your money to good use. Do you have any favourite saving tips to share? I’d love to hear them – drop them below! And remember to follow us on Instagram @tweedcoasthomeloans for more great info.

Happy spending, savvy shoppers!

Alex.