Shopping for a home loan and feeling a bit frazzled?! It’s hardly surprising. Unless you’re a seasoned property buyer, you might find yourself feeling overwhelmed and under-educated when it comes to all things home loans. There’s a lot of choice, and with it, a lot of jargon to decode.

Hi! I’m Lindsay Olsen, an Australia-wide mortgage broker who’s also invested in financial education, and vehemently against bamboozling my clients.

Mortgage brokers exist to remove the hassle of home loans – but we also want you to feel empowered. When you’re making the huge financial commitment of purchasing property, and particularly if you’re looking to grow a portfolio, it makes sense that you might want to really understand how home loans work. And so, we present you this A-Z* guide to decoding home loan jargon.

Happy to get on with your life without knowing your LMI’s from your LVRs?! GREAT! Get in touch – we’re more than happy to deal with the bank stuff and leave you to the fun stuff.

Still keen for the home loan crash course? Buckle up – let’s look at some of the more common phrases bandied around by mortgage brokers and real estate agents.

Annual percentage rate (APR)

An annual percentage rate factors in any recurring fees and charges over the life of your home loan. These may include monthly account keeping fees or annual package fees.

The APR is a great comparison tool when deciding between multiple loans. The APR uses your loan amount and loan term to highlight the equivalent interest rate after fees and charges. For example, a loan with a low interest rate but high fees, might actually cost you more each year than a loan with a slightly higher interest rate but no fees.

The annual percentage rate is also known as the true interest rate.

Approval in principle

Approval in principal is also known as a pre-approval or pre-approved home loan. It’s essentially a preliminary assessment of your ability to borrow money from a particular bank.

Once you provide your information to the bank, they’ll determine what they’re prepared to lend you, and on what terms. A pre-approval will outline how much you can borrow from the bank. From this you can figure out what your purchase price could be once you factor in your saved deposit. You’ll also need to allow for costs like stamp duty. Note – your mortgage broker can work all of this out for you.

A pre-approved home loan is an excellent idea when you’re looking to buy a property. A pre-approval is usually valid for 90 days (sometimes 60 days, sometimes 120 days). It allows you to shop with confidence, knowing there’s a lender who’ll provide you with the funds you need.

Bridging loan

A bridging loan is a short-term loan that allows you to purchase a new property before you sell your existing property. (Also known as bridging finance).

Cash out

Cash out refinancing allows you to access some of the equity within your home. Your home loan limit will be increased by the amount of cash you’d like to access, and the lender will deposit the ‘cash out’ amount into your bank account. Your monthly repayments are calculated on the total amount of your existing home loan plus the cash out amount.

Comparison rate

The comparison rate is an interest rate that all lenders must show. The purpose is to help customers make a more informed decision about their home loan options. While the home loan interest rate is purely the amount of interest the bank charges, the comparison rate also includes the fees and charges that are included with the loan product.

Comparison rates use the standard figures of $150,000 borrowed over a 25-year loan term. This allows customers to compare options at a glance.

If you’re looking for a more accurate comparison tool, the Annual Percentage Rate (APR; see above) is tailored to your loan amount and loan term.

Construction loan

Construction loans are short-term loans (1 to 2 years) that allow borrowers to meet the progress payments set out within their building contract whilst building a new house. These loans have multiple ‘drawdowns’, meaning the loan limit is split into smaller portions that will be disbursed at pre-determined stages. Typically, the drawdowns happen at the following stages of construction:

- Concrete slab poured – foundations laid

- Frame – house frames, roofing, windows

- Lockup – external walls, lockable doors

- Fit out – plumbing, electrical, internal wall linings

- Completion – finishing touches, final plumbing and electrical

Construction loans are typically structured with interest only repayments during construction. This allows for better household cashflow through the construction phase, particularly if you’re renting.

Debt to income ratio (DTI)

The debt-to-income ratio is a calculation that many banks use to work out your borrowing risk. The bank needs to know that you’ll be able to make your home loan repayments. Debt-to-income ratio looks at your total level of debt (existing and proposed) divided by your total income before tax. If your debt-to-income ratio is over ~7, fewer banks will be willing to lend to you.

Deposit

Your deposit is the amount of your own cash/savings you’ll put towards your house purchase. In order to avoid paying lenders mortgage insurance you should aim to save a 20% deposit. LMI is an insurance policy that protects the bank if you default on your home loan.

When your offer to buy a house is accepted, you’ll need to pay a deposit to the real estate agent’s office. A house deposit is typically 5% to 10% of the purchase price.

At settlement you’ll need to provide the remainder of your deposit to your solicitor or conveyancer. This party will ensure all the funds are directed correctly to complete the transaction.

Equity

Home equity is the part of your property you actually own. To calculate your home’s equity, subtract your outstanding loan balance from the current market value of your property. To learn the market value of your home, use this home equity calculator. Home equity will increase as you pay down your loan, or the market value of your home increases.

Exchange contracts

Exchanging contracts is part of the real estate buying process. Once an offer to purchase is accepted by the vendor (the person/s selling the property), both the buyer and seller will sign a copy of the contract of sale and ‘exchange’ their copy with the other party.

This is a significant milestone in the buying process as you’re now able to seek formal approval from your lender. Next stop: settlement!

Fixed rate mortgage

Fixed rate mortgages offer an interest rate that doesn’t change for a pre-determined period of time. In Australia, fixed rate mortgages are offered for between 1 and 5 years and sometimes up to 10 years.

Fixed rate mortgages are typically suited to people who need certainty in their monthly repayments.

By comparison, you can opt into a variable rate mortgage. This offers an interest rate that is subject to change over the course of the loan. Variable rates are suited to people looking for the cheapest interest rate or who feel that rates are more likely to decrease than they are to increase.

Guarantor

A guarantor offers the equity in their house as security for a family member to purchase a house. Guarantors are usually only needed when the purchaser doesn’t have sufficient deposit to avoid paying lender’s mortgage insurance. Instead of the purchaser saving up cash, the guarantor offers the bank a limited guarantee to the equivalent value required.

Guarantors ‘guarantee’ the bank will get their money even if the main party on the loan defaults (can’t make their repayments).

While there is a guarantee in place, the bank holds a mortgage over both the guarantor’s and the purchaser’s properties. The bank has the power to sell both properties if the debt isn’t repaid. So it’s in the interest of the guarantor to be comfortable that the borrower can repay the loan without any issues.

If you have a guarantor loan and you have paid off enough of your loan (so that your loan to value ratio is 80% or less) then the guarantor and their property can be released from the contract.

Home Guarantee Scheme (HGS)

The Home Guarantee Scheme is a Federal Government initiative that allows eligible first home buyers to purchase property with as little as a 5% deposit. It also provides assistance to single parents looking to purchase with as little as a 2% deposit.

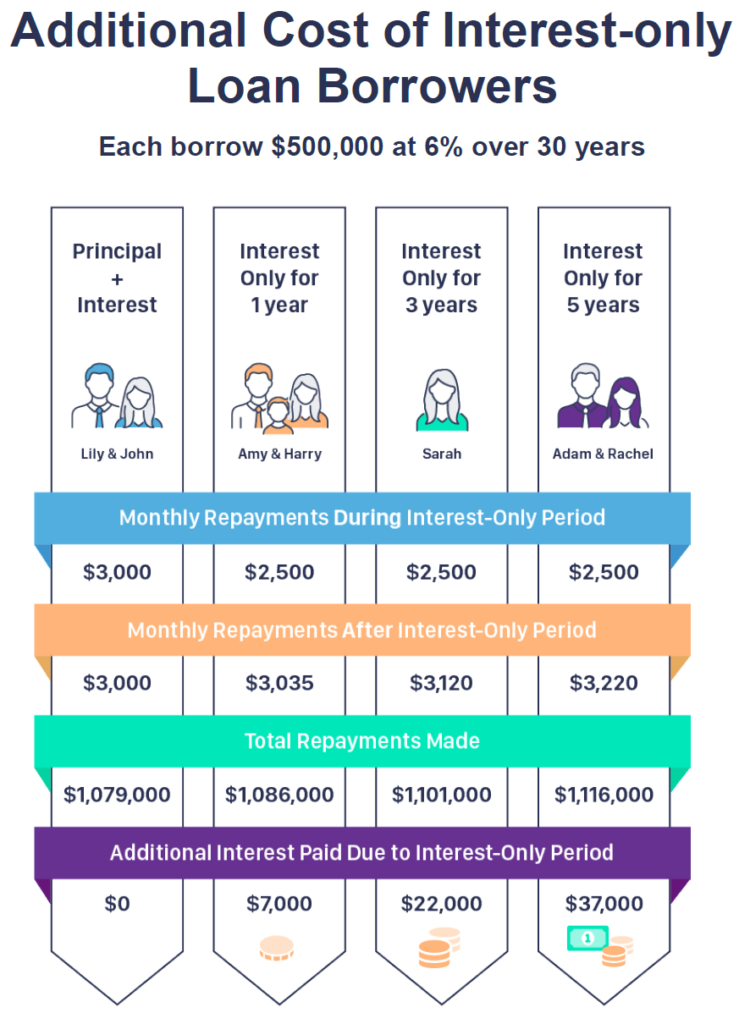

Interest only repayments

Interest only loans allows customers to only repay the interest accrued in the past month. These loans are available for 1 to 5 years, with the remainder of the loan set to principal and interest repayments.

Popular with investors, interest only repayments increase household cashflow by reducing the repayment amount due each month.

By choosing interest only repayments, you’re electing not to pay off any of the original loan limit. This means you’ll ultimately pay more in interest over the course of the loan.

The chart below shows the additional interest that home owners might pay long-term after an interest only period.

Joint tenants

Joint tenants refers to more than one purchaser who own a property jointly, or evenly. If one purchaser passes away their share of the property automatically transfers to the surviving owner.

The other common purchasing structure where there is more than one purchaser is tenants in common, which is where purchasers are able to nominate ownership in uneven portions. If one of the owners dies their share forms part of their estate, rather than ownership automatically passing to the surviving owner(s).

It’s common for married or de facto couples to purchase their homes as joint tenants, rather than tenants in common.

Lenders mortgage insurance (LMI)

LMI is an insurance policy that protects the bank if you default on your loan (can’t make your repayments). In most cases, if your loan to value ratio is higher than 80%, you’ll be required to purchase LMI. LMI doesn’t cover you as a borrower, it only protects the bank’s interests.

Loan amortisation

Put simply, loan amortisation is the way your loan repayments are calculated. Using the current interest rate, the amount borrowed and the remaining time left on your loan, it’s possible to determine what your monthly repayments will be and how much would be left on the loan at any given point in the future.

Loan to value ratio (LVR)

Loan to value ratio is the size of your loan compared to the sale value of your property.

When purchasing a new property, the common benchmark is to aim for 80% LVR maximum. This means you should have saved cash to cover the remaining 20% of the purchase. (You also need to save for purchase costs like stamp duty and legal fees.) If your loan to value ratio is 80% or lower, you won’t be required to pay lenders mortgage insurance. This could save you thousands of dollars.

Mortgage broker

Mortgage brokers work on behalf of clients who are looking to borrow money. Brokers advise and educate borrowers about their choices when it comes to selecting a loan. On behalf of clients, a broker will research the most appropriate home loans, negotiate interest rates on your behalf direct with the banks, and then provide a shortlist of loan options and their recommendation.

Once a client has chosen the loan, the mortgage broker will oversee the entire application process. This goes right through to settlement, and beyond. (At Tweed Coast Home Loans we perform annual check-ups to make sure you’re still on a good rate.)

Whereas individual banks only offers a handful of loan options, mortgage brokers are accredited with multiple banks and lenders. (Tweed Coast Home Loans is accredited with 40+ lenders including Australia’s 4 big banks). This allows your broker to research from hundreds of loan options. Mortgage brokers have access to banks that many clients may not have heard of, as well as unadvertised interest rates.

One of the major bonuses (often met with surprise) is that most mortgage brokers don’t charge a fee. Instead, we earn a commission from the lender. It’s worth mentioning that brokers are bound by Best Interests Duty (BID). This means we must make recommendations in the best interests of the client, not ourselves. (Note: banks are not bound by Best Interests Duty).

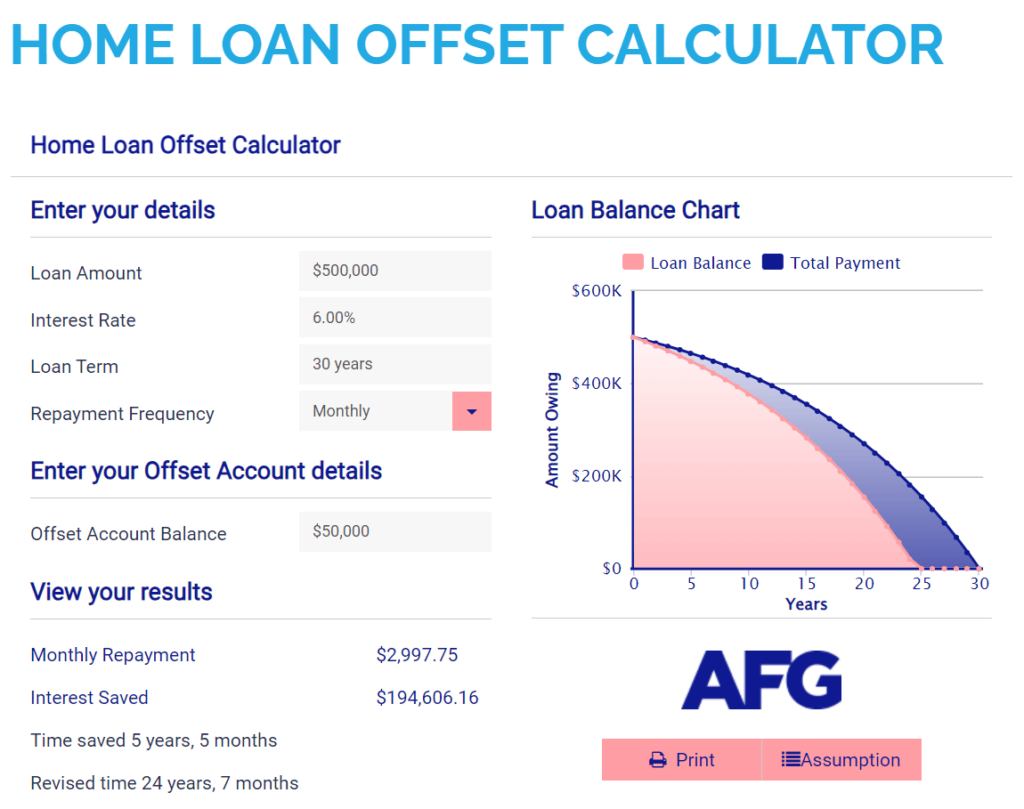

Offset account

An offset account is a fully transactional bank account that is linked to your home loan. The purpose of an offset account is to reduce the amount of interest paid over the life of your loan.

The balance in your offset account effectively reduces the balance of your home loan for interest calculation purposes only. You still owe the full amount, and you still have access to all the money in your offset account. Interest is calculated on the balance of your home loan minus the balance of your offset account, rather than the full home loan balance.

For example, if you have a $500,000 loan and you have $50,000 in your offset account, you only pay interest on $450,000. On a home loan with a 6% interest rate, this could save you over $190,000 in interest and over 5 years off your loan. You can plug your own numbers into our offset calculator.

Pre-approval

A pre-approval (aka approval in principal) is a preliminary assessment of your ability to borrow money from a particular bank. Based on your information and documentation, the bank will determine what they’d be prepared to lend you, and on what terms. A pre-approval will outline how much you can borrow from the bank. From this you can figure out what your purchase price could be once you factor in your saved deposit, and allow for costs like stamp duty. (Note – your mortgage broker can do all this for you.)

A pre-approved home loan is an excellent idea when you’re looking to buy a property. A pre-approval is usually valid for 90 days (sometimes 60 days, sometimes 120 days). It allows you to shop with confidence, knowing there’s a lender who’ll provide you with the funds you need.

Principal and interest repayments

If you’re making principal and interest repayments it means that your periodic payments (usually monthly) cover some of the amount of you borrowed (the principal) as well as the interest.

Therefore, principal and interest repayments actively reduce the loan balance, while also paying off the interest charged.

Principal and interest repayments are higher than interest only repayments but you’ll ultimately pay less in interest by choosing principal and interest. This is because with each repayment, there is less of the principal amount to charge interest on.

Rate lock

Rate lock is a feature offered only on fixed rate mortgages, whereby you can pay a fee to safeguard against the interest rate rising in the time between your loan application and settlement. Depending on the bank, the rate lock fee could be a fixed price, or it may be a percentage of the loan amount.

Redraw facility

A redraw facility is common to nearly all new home loans. A redraw facility allows you to have access to any extra repayments you may have made on your loan, simply by transferring the funds via internet banking. Say you’ve had your loan for 5 years and have made $10,000 in additional repayments over that time, a redraw facility will let you take that $10,000 out of your home loan at any time, often without fees and charges.

Refinance

Refinancing, in short, means switching home loans. It’s the process of changing your home loan provider for the purpose of getting a better deal. While the loan you initially signed up for is likely to have been competitive at the beginning, after a few years there’s a high likelihood that there’s a better option. You don’t have to stay with the same lender. You can refinance your home loan to a new bank to take advantage of their current offers and improve your monthly cash flow.

Settlement

Settlement is the final stage of the sale when the purchaser completes the payment of the contract price to the vendor (seller), and takes legal possession of the property. The property title is transferred to the purchaser’s name, all monies are paid, the home loan begins, and you get the keys to your new home.

Most people use the professional services of a solicitor or conveyancer to assist them with the settlement process as it’s a highly nuanced area.

Split loan

A split loan means your loan is divided into 2 or more smaller loans. The advantages of a split loan include: each split can be used for a different purposes (for example, owner occupied loan or investment loan); you can have different repayment structures (for example, principal and interest or interest only); or you could have a portion of your loan on a variable interest rate and the remainder of your loan on a fixed interest rate.

Stamp duty / transfer duty

Stamp duty, or transfer duty, is a state-based tax on the purchase of certain items, most notably, property. It is typically in the order of 3.5% to 5.5% (varies by state and purchase price) of the purchase price and is payable at settlement.

When saving for a house, don’t forget to save for stamp duty!

Stamp duty exemptions are available for eligible first home buyers in most states. You can check the exemptions for your state on our stamp duty calculator.

Tenants in common

Tenants is common is one of two common purchasing structures when there is more than one purchaser. This agreement allows for the two purchasers to own either equal or unequal portions of the property. If one purchaser passes away their share of the property does not automatically transfer to the surviving owner but forms part of the deceased’s estate.

Under contract

Under contract is the period of time when a seller has accepted a buyer’s offer, but the seller still wants the house listed as active. The sale contract will include a number of clauses that spell out requirements before the sale is final. Typical clauses include ‘subject to finance’, meaning, the purchaser can back out of the contract without penalty within a set period of time if they can’t arrange the required finance; and ‘subject to building and pest inspection’, meaning, the purchaser will engage a contractor to inspect the house for signs of pest damage and ensure there are no major building concerns (if the inspection reveals concerns for the buyer, they may walk away from the purchase without penalty under the ‘subject to building and pest inspection’ clause).

While the house is still under contract, the seller will likely accept backup offers in case their current offer fails to meet its requirements.

Variable rate mortgage

Variable rate mortgages offer an interest rate that is subject to change over the course of the home loan. Fluctuations in variable interest rates usually depend on the national economy at any given point in time.

Variable rate mortgages suit people looking for the cheapest interest rate, or who feel that rates are more likely to decrease than increase.

By contrast, fixed rate mortgages offer an interest rate that doesn’t change for a pre-determined period of time. In Australia, fixed rate mortgages are offered for 1 to 5 year and sometimes up to 10 years.

Fixed rate mortgages suit people who need certainty in their monthly repayments.

Valuation

When purchasing a property, or refinancing your existing loan to a new lender, the incoming bank will want proof of the value of the property they hold as security. A valuation is conducted to verify that you have paid reasonable market value for the property.

The valuation will assist in calculating the loan-to-value ratio (the size of your loan compared to the sale value of your property, quoted as a percentage, and used to determine whether or not you need to pay lenders mortgage insurance as security for the bank).

Valuations can be automatically generated by specialist software, or may require a certified valuer to inspect the property to determine its true market value.

Conclusion

Home loans can be complex beasts, and although it’s great to wrap your head around a few terms, the good news is, you don’t have to become an expert! If you’re ready to buy property or thinking of buying in the future, be sure to save us to your favourites so we can make your home buying journey enjoyable – as it should be! If you think we’ve missed any jargon in this list, let us know in the comments!