When you’re buying a house, you’re met with so many questions: Which suburb should we buy in? How many bedrooms will we need? Is this in the right school catchment area for us?

Similarly, when you’re looking for your home loan there are just as many questions: Which lender should we go with? Should we get a variable interest rate or a fixed interest rate? Do we need an offset account? (And what even is that?)

But before you get into all of those details, there’s an important question – do you need a mortgage broker to get a home loan?

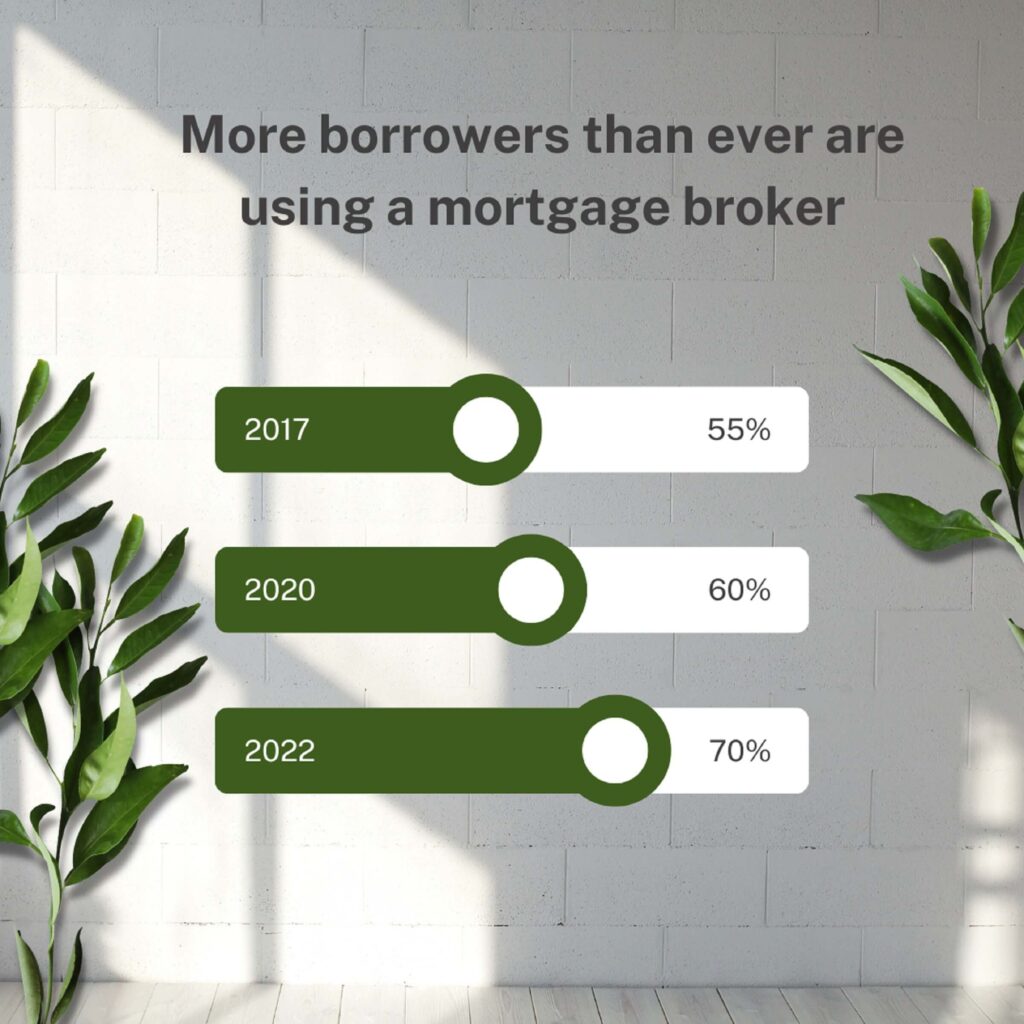

Before we get to the answer, let’s take a look at what your friends and family are doing.

Australians are using the professional services of mortgage brokers at record rates. In just the past 5 years the percentage of home loans written by mortgage brokers has risen from 55% in 2017 to 70% in 2022. This means that 7 out of every 10 home loans are arranged by a mortgage broker, and the predictions are that this trend is only going to keep rising.

In this post we’ll look at the reasons why it makes sense to enlist the services of a qualified professional mortgage broker when finding your next loan.

Article summary

What does a mortgage broker do?

Mortgage brokers work on behalf of people who want to borrow money

- Brokers search for and refine lending options that suit the customer’s needs

- Brokers help customer choose and apply for loans

- It takes brokers between 20 and 40 hours to work through all the nitty gritty for a client’s loan from start to finish.

Why should you use a mortgage broker?

Brokers are industry experts who work on your behalf to find and lodge your loan. They bring you loan options from a variety of lenders, with more competitive rates than if you were to just approach one bank yourself.

How does a mortgage broker get paid?

Most brokers don’t charge a service fee and rely solely on commissions paid by the bank or lender.

- Brokers only get paid if you proceed with a loan

- Payments are typically made about a month after settlement.

What can you expect when working with a mortgage broker?

A broker will enquire about your goals (short and long term) so they can understand what type of loan would suit you best

- They’ll request evidence of your income, expenses, assets and debts

- Mortgage brokers are required by law to adhere tp the ‘best interests duty’ meaning they must always act in the customer’s best interests.

Do you need a broker to get a home loan?

You didn’t hear this from me, but no, you don’t need a broker to get a home loan. However, just like you don’t need an accountant to do your taxes, and you don’t need a real estate agent to sell your house – you outsource these things to professionals who know their industry inside out. They can get you a better result. With so many lenders out there, each offering many different deals and rates, it can be a hard slog doing your own research on which lender and product is best for you – and then convincing them to lend to you. A mortgage broker simplifies the whole process.

What does a mortgage broker do?

Mortgage brokers help people to borrow money. Working closely with the client, the broker finds loan options and makes a recommendation. They then oversee the entire application process from lodgement to approval, and through to settlement (when you get your keys). Mortgage brokers advise borrowers about their choices when it comes to selecting a loan. A good broker takes the time to understand your requirements and objectives before recommending a loan for you.

When you and your broker have established your objectives and you’ve sent through the documentation needed (which will include identification, family circumstances, and records of income and expenses), you’ll be sent what’s called a ‘comparison report’ which shows loan options for you to choose from. Once you’ve made your choice your broker will lodge the application for you.

Why should you use a mortgage broker?

Why are more Australians using mortgage brokers to get a loan, instead of just going to the bank? And what’s driving the growth of people using brokers at such a rapid rate?

Is it because a broker can show you multiple lenders suited to your personal circumstances, rather than a bank only offering you one option? Is it the fact that most brokers don’t charge a fee for their services? Or is it because banks are closing down brick-and-mortar branches, making it harder to walk in and talk to someone in person? There’s a combination of factors leading people to brokers over banks.

Physical bank branches are becoming a rarity these days with many banks focusing on online services, and some not offering branches at all. While people aren’t necessarily fussed about walking into a branch, they typically do want to be able to talk to someone about their loan options, whether that’s trying to find the best deal for them, or simply trying to figure out if they can afford anything right now. This is where mortgage brokers play an important role – providing a ‘real human’ contact, and a genuine, ongoing broker/client relationship, often for many years.

A mortgage broker can show you where you’re at compared to where you want to be.

A broker can carefully analyse your options and filter out the noise, saving you time and getting you a better deal. If you deal directly with a single bank, they can only offer you their loans, whereas a mortgage broker can offer you products from a wide range of lenders. The majority of brokers will have roughly 30 or so lenders on their panel to choose from.

I have a theory that most people looking for a home loan would be stretched naming half that many banks. (Have a go at it! Give yourself one Google-free minute to see how many banks you can name off the top of your head; let me know how you go in the comments section). If my theory is correct, there will be quite a few lenders on a mortgage broker’s panel that you haven’t even heard of. Some of these banks are exclusively online, and others only have branches in one or two states. A mortgage broker can get you access to many competitive products that you wouldn’t even know existed if you were trying to DIY your home loan.

Further, brokers are across the lending policies of different banks, which means they understand which banks like lending to which types of customers (for example, first home buyers, investors, or the self-employed).

Why use a broker, if you can easily use an online loan comparison tool?

Online comparison sites are okay for finding cheap rates, but they’re no match for a human strategist who can factor in your unique situation and requirements to match with banks that will actually lend to you. What use is finding a cheap rate online only to go through the application process to then be told you don’t qualify for that product? A mortgage broker removes all that hassle for you.

Trying to find a loan without a broker can be an extremely stressful process – particularly if you’ve found a house you want to buy and you’re in a rush to secure it. If you don’t use a broker, but instead you only approach one bank for a loan, you run the risk of the buying process being delayed if your application is declined. Whereas when a broker is working on your behalf, loan applications are far less likely to be declined, and even if your application is declined with one bank, the broker can move swiftly to approach another lender. Without a broker you’d need to research new lenders yourself, and start from scratch with another lengthy application process. Meanwhile, someone else’s offer may be accepted for the house you wanted to buy.

Will it cost me anything to use a mortgage broker?

You’ve asked whether you need to use a mortgage broker to get a loan, and we’ve told you it’s strongly in your best interests to do so. So now you might be wondering what it will cost you to use a broker. The answer is – nothing. Most mortgage brokers don’t charge their clients a fee (myself included).

So, if you’re wondering how we earn an income, here’s a little more info.

Mortgage brokers are paid a commission from the bank/lender after you buy your house.

This commission is made up of two components: an upfront commission (from the bank) and a monthly trailing commission (an ongoing monthly payment for the life of your loan, from the bank). The commission is only paid if you go ahead with your loan through the broker and payments are usually paid about a month after your loan settles. Most lenders offer brokers comparable commission payments, which helps assure customers that loans recommended to them aren’t influenced by the payment to the broker.

That’s a pretty good deal for home buyers, isn’t it? Considering the costs associated with buying a house are high in the first place, I think it’s a great deal to have an industry professional research, compare and recommend a loan option for you at no additional cost. Imagine if you could get your tax return done by an accountant for free – I’d sign up for that!

What can you expect when working with a mortgage broker?

- Mortgage brokers are required to adhere to a strict ethical code of practice and are bound by legislation known as ‘best interests duty’ (BID). The purpose of BID is to ensure the broker always acts in the best interests of borrowers rather than themselves. For clarity, only brokers have to comply with BID, not banks.

- Before you meet with a broker, you’ll be asked to complete a fact-find in order for the broker to understand your needs. You may also be asked to provide supporting documents such as pay slips, tax returns and bank statements to show your income and expenses.

- The face-to-face meeting (or virtual meeting) with a broker will follow a process something like this: getting to know you, understanding and prioritising your needs and objectives, establishing your financial goals, summary of your income, expenses, assets and liabilities, and a discussion about home loan features and benefits. As a broker I love nothing more than knowing my clients are engaged with the process by asking great questions. Before meeting with your broker make sure you take a moment to think about any questions you might have for them about your personal circumstances or the home buying and loan application process.

- From here your broker will go away and research the most appropriate options for you, negotiate interest rates on your behalf direct with the banks, and then provide you with a shortlist comparison report and their recommendation.

BONUS TIP

It’s a good idea to start working with a mortgage broker about 3 months before you want to buy. This time will enable you to make sure all your ducks are in a row to present yourself to the lender. You can use this time to cut back on spending, cancel unnecessary subscriptions and memberships and increase your savings – all the things that banks love to see.

Should you contact a broker if have an existing home loan?

Yes! In this period of rising interest rates many of you will be taking a closer look at your finances to make sure your current loan arrangements are right for you. While all lenders had to pass on interest rate rises, depending on how long you’ve had your current loan for, you may still be paying too much in interest.

This was confirmed by a report published by The Australian Competition & Consumer Commission (ACCC) in November 2020 (‘Home loan price inquiry’) which found that the longer you stay with your lender, the higher your interest rate is likely to be. There’s no reward for staying with the same lender for the life of your loan, and no downside to switching to another lender who can give you a better rate.

Can Tweed Coast Home Loans help you?

- Do you need a new loan?

- Do you have an existing loan?

- Have you been thinking of reassessing your finances?

If you answered yes to any of the above, reach out to us today – we’re based in Northern NSW but work with clients all over Australia. Now, if you need a new loan, we can help find you a good one. Or, if you’ve had the same loan for a few years, we might be able to find you a better deal. It’s worthwhile getting a broker to look at your loan every few years to make sure you’re still getting a good deal (you could save quite a bit of money).

We pride ourselves on backing our service with an exceptional client experience. As part of our service to you we’ll negotiate your interest rate with the banks before lodging your application. Not only that, but we’ll stay on top of it by conducting annual rate checks with your bank to ensure you continue to get a competitive deal.

So now, let me ask you a question:

Do you need a mortgage broker??

If you’re still on the fence you can call, text or email me to see how I can help you.

Or, if you’re ready to take action today, I invite you to schedule a time with me directly in my calendar and we’ll get to work straight away.

Lindsay