Is 2023 the year you’ll put a foot on the property ladder? Or are you already an owner and looking to purchase again? Either way, you’ve come to the right place. We’re going to cover off everything you need to know about getting a home loan in 2023.

But wait… isn’t this a TERRIBLE time to buy property?!

Some nay-sayers will tell you that interest rates are too high now, and you’ll never afford a property because of it. Not true. Yes, rates have increased over the past year or so, but did you know this has been the first period of interest rate rises in 10 years, from historically low levels? In fact, interest rates today (February 2023) are still lower than the long-term average. So don’t hold your breath for interest rates to decrease. Rates are predicted to rise again and then level out towards the end of the year into 2024 – not to go back down where they were.

Interest rates aside, the bigger issue facing most Australians is how to save a deposit to purchase property. The good news about increased interest rates is that house prices have reduced slightly, which means you won’t need to save as much of a deposit as you would have had to a year ago, and you won’t need to borrow as much to buy. Win! If you’re still working on saving a deposit though, you’ll want to grab my Top tips to make the banks love you (it contains some great tips to put you in the best position to get a home loan).

At a glance – here’s what we’ll cover:

- What are the steps to get a home loan?

- How long does it take to organise a home loan?

- Are all home loans the same?

- What is the ‘first home buyer’s grant’?

- What are your options if you don’t have much of a deposit?

Now – are people selling houses this year? Yes!

Are people buying houses this year? Yes!

Okay, let’s dive in and look at what you need to know about getting a home loan in 2023.

What are the steps to get a home loan?

There are 6 main steps to getting a home loan:

- Save a deposit

- Research banks with a mortgage broker

- Lodge pre-approval application

- Find a house to buy

- Get unconditional loan approval

- Settlement – or when you get your keys!

Save a deposit

At a minimum you’ll want to save 5% deposit before you buy a property, but ideally, you should aim to save 20% of the purchase price plus about 5% to cover purchasing costs. Saving this 20% plus costs will help you avoid having to pay Lenders Mortgage Insurance (LMI). LMI is an insurance that protects the bank in the event a borrower defaults on their loan (aka can’t make their repayments).

Research banks (get a broker to do this for you)

You’ll need to research different banks to figure out if they’ll lend to you and how much. Because there’s hundreds of lenders to choose from (each offering multiple options) there’s a broad scope of borrowing capacity. To save you doing all the tedious researching, mortgage brokers are equipped with specialist software to easily compare lenders against each other and help you decide which bank is a good fit for your specific circumstances.

Lodge pre-approval application

Once you’ve chosen a bank and a home loan, your mortgage broker can prepare and lodge your application on your behalf. If you haven’t found a property yet, this will be a pre-approval (also known as conditional approval). With a pre-approval in hand, you can go property shopping!

Find a house, and get unconditional approval

When you’ve found a property you like, your offer is accepted and you’ve exchanged contracts with the seller, you’ll seek ‘unconditional approval’ of your home loan from the bank. This is a formal acceptance of your home loan application and ranks second on the excitement-meter only to the feel of your new house keys in your hot little hands! Woo-hoo!

Settlement

After you receive unconditional approval you’re one step closer to settlement. In most states settlement usually happens about 6 weeks after you’ve exchanged contracts. Settlement is the legal process of transferring the property title from the seller’s name into yours and is the day your mortgage begins… oh yeah, and you finally get the keys!

How long does it take to organise a home loan?

The timeframe from engaging a mortgage broker to getting unconditional loan approval could be as little as a week if you’ve already found a house to buy.

On the other hand, it could be more of a 6 to 12-month journey of preparations (organising finances or saving a deposit) before you’re ready to purchase. The actual process or arranging a loan though usually takes between a few days to a few weeks depending on the lender, and the complexity of your loan.

Are all home loans the same?

Yes and no… but mostly no.

Yes, in that all home loans allow you to buy property using someone else’s money (the bank’s), and they’ll charge you interest to do so.

But that’s where the commonalities end. Each bank has different lending policies and their loans are structured differently, with varying interest rates and fees, and add-ons to confuse you help you.

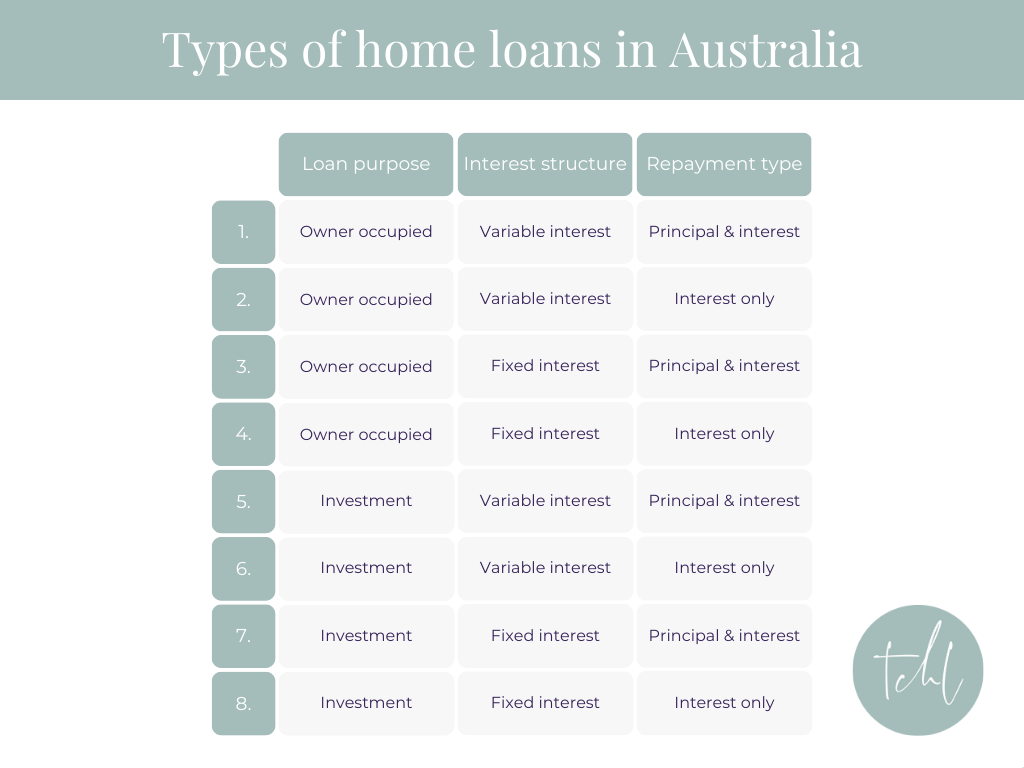

That’s the short answer! Fundamentally (you can tell we’re getting serious now) there are 8 distinctly different loan types, based on the purpose of the loan (owner-occupier or investment), the interest structure (variable interest or fixed interest) and the repayment type (principal and interest, or interest-only).

Let’s deal with the jargon first:

- Owner occupied: a house you will live in

- Investment loan: a house you will rent out

- Variable interest: your interest rate can go up or down depending on current economic conditions

- Fixed interest: your interest rate stays the same in the nominated fixed interest period (1–5 years)

- Principal and interest (P&I) repayment: the amount of money you owe the bank reduces with every P&I repayment as you’re paying off some of the original debt and some interest. Monthly repayments are higher in comparison to an interest-only arrangement, but you’ll pay less in interest over the term of the loan

- Interest-only (IO) repayment: the amount of money you owe the bank stays the same with every IO repayment as you’re not paying off any of the original debt amount. Monthly repayments are lower in comparison to a principal and interest arrangement, but you’ll pay more in interest over the term of the loan.

And here are the different loan structures:

Just to add even more options (if you’re confused, don’t worry, this is why mortgage brokers exist) there are usually fixed interest options of between 1 and 5 years with each bank, and interest-only periods of 1, 3, 5 or 10 years with some banks. At the end of a fixed interest period the loan reverts to variable interest for the remainder of the loan. At the end of an interest-only period the loan reverts to principal and interest repayments for the remainder of the loan.

Errrr… still not tapped out with complexities?! Alrighty! Some loans also come with additional features like offset accounts or access to fee-free credit cards. These loans typically attract different interest rates and/or fees when compared to basic standalone home loans.

A single bank could have dozens of different home loan options for you to choose from and there are over 100 different banks operating in Australia. So on the plus side, there’s plenty of choice when it comes to picking a bank and a home loan that’s right for you. It’s overwhelming though, isn’t it? This is where a mortgage broker can help you. A broker can explain the differences and pros and cons of different loan types, and better still, whittle down their recommendations to suit your personal needs. If you’d like to talk with me about your options, just send through your enquiry here (I don’t charge a fee for consultation, or any service, for that matter).

What are first home buyer grants?

Most states and territories in Australia offer Government incentives to support first home buyers, in the form of first home buyer’s grants (also known as first home owners grants) and/or stamp duty exemptions (for the uninitiated, stamp duty is a government tax you have to pay when you buy property or land). Exemptions and assistance vary from state to state.

If you’re a first home buyer, Google the ‘office of state revenue’ website for your state to view the assistance available and grant eligibility criteria. In general though, the following criteria are common to most states and territories for first home owner’s grants:

- You must be at least 18 years old

- At least one applicant must be a permanent resident or Australian citizen

- You must be a first home buyer in your personal name (not a company or trust)

- You or your spouse can’t have claimed the grant previously

- You or your spouse can’t have owned residential property prior to 1 July 2000

- You or your spouse can’t have lived in a home either of you owned on or after 1 July 2000

- You must start living in the home within the first 12 months, for a continuous period of at least 6 months (12 months in some states).

Below is a summary of the grants available and an indication of the stamp duty relief that may be available in each state, as at February 2023.

What is the first home buyer’s grant in NSW?

A $10,000 grant is available when you buy or build your first new home for:

- new homes up to $600,000

- substantially renovated homes up to $600,000

- house and land packages up to $750,000.

Stamp duty exemption available (no stamp duty payable on purchases below the threshold) for:

- new homes up to $650,000

- existing homes up to $650,000

- vacant land up to $350,000.

Stamp duty concession available (reduced stamp duty payable on purchases in the range) for:

- new homes between $650,000 and $800,000

- existing homes between $650,000 and $800,000

- vacant land between $350,000 and $450,000.

NSW First Home Buyer Choice (stamp duty or land tax choice)

NSW is the only state in Australia to offer first home buyers the choice between paying stamp duty upfront at the time of purchase, or paying an annual property tax.

This option is available for purchases of:

- new homes up to $1,500,000

- existing homes up to $1,500,000

- vacant land up to $800,000.

What is the first home buyer’s grant in QLD?

A $15,000 grant is available when you buy or build your first new home for:

- new homes up to $750,000.

Stamp duty exemption available (no stamp duty payable on purchases below the threshold) for:

- new homes up to $550,000

- existing homes up to $550,000

- vacant land up to $400,000.

What is the first home buyer’s grant in VIC?

A $10,000 grant is available when you buy or build your first new home for:

- new homes up to $750,000.

Stamp duty exemption available (no stamp duty payable on purchases below the threshold) for:

- new homes up to $600,000

- existing homes up to $600,000.

Stamp duty concession available (reduced stamp duty payable on purchases in the range) for:

- new homes between $600,000 and $750,000

- existing homes between $600,000 and $750,000.

What is the first home buyer’s grant in SA?

A $15,000 grant is available when you buy or build your first new home for:

- new homes up to $575,000

What is the first home buyer’s grant in WA?

A $10,000 grant is available when you buy or build your first new home. The cap on the total value of the home and land varies depending on where the home is located, as follows:

- south of the 26th parallel, homes up to $750,000

- north of the 26th parallel, homes up to $1,000,000.

Stamp duty exemption available (no stamp duty payable on purchases below the threshold) for:

- new homes up to $430,000

- existing homes up to $430,000

- vacant land up to $300,000.

Stamp duty concession available (reduced stamp duty payable on purchases in the range) for:

- new homes between $430,000 and $530,000

- existing homes between $430,000 and $530,000

- vacant land between $300,000 and $400,000.

What is the first home buyer’s grant in NT?

A $10,000 grant is available when you buy or build your first new home.

What is the first home buyer’s grant in ACT?

The ACT doesn’t offer a cash grant to first home buyers.

The state does, however, offer a stamp duty concession scheme based on household income and number of dependents. The current maximum concession is $34,790.

What is the first home buyer’s grant in TAS?

A $30,000 grant is available when you buy or build your first new home.

Stamp duty concession available (reduced stamp duty payable on purchases in the range) for:

- established homes up to $600,000.

For more information, head to the ‘office of state revenue’ website for your state or territory.

What are your options if you don’t have much of a deposit?

There are a few unique purchasing arrangements that can benefit people with small deposits. These include using a guarantor, purchasing property with others, accessing special Government schemes or leveraging your super. Read on!

Using a guarantor

Most home buyers either purchase by themselves or with their partner, but sometimes it can make sense to get assistance from others, too.

Some new buyers may have family who can act as a guarantor for the loan by offering their house as security or collateral for the new loan. Having someone as a guarantor reduces the deposit needed by the borrower; it also gets around the need to pay Lenders Mortgage Insurance (LMI). Essentially, this means you can buy a property sooner, even if you don’t have the whole deposit yourself.

This guarantor scenario is useful where the borrower has sufficient income to pay off (a.k.a. ‘service’) a loan above 80% LVR (Loan to Value Ratio), but where they haven’t yet saved enough of a deposit to cover 20% of the purchase price plus purchasing costs.

In other words, it means you can buy a property sooner, even if you don’t have the whole deposit yourself.

Over time as you pay down the loan and (hopefully) your property increases in value the LVR will reduce to a point where it is below 80%. When this happens, the guarantors can be removed from the loan.

(Just a side note, whenever a guarantor is involved it’s important that they get independent legal and financial advice so they’re fully aware of any risks should the borrower default on the loan.)

Purchasing property with friends (or strangers)

What if you don’t have someone who can act as a guarantor? Are there any other options?

There’s an increasing trend for friends, and even strangers, to purchase property together (which you might have come across in the Aussie TV drama, Five Bedrooms). This type of arrangement can work for either investment purposes or for all owners to live together. There are even companies that exist to help people find like-minded individuals to co-own a home with. Mortgage Mates describes itself as ‘the Bumble of home ownership’. They’re an online platform that can match you with other people who have the same housing preferences as you, to co-own a home together under a specialist legal framework known as ‘tenants in common’.

Government incentive schemes

There are incentive schemes from the Federal Government to assist people to buy houses to live in, although these are limited to first home buyers and single parents. You can check your eligibility for the scheme here.

The Home Guarantee Scheme (HGS) is an Australian Government initiative to support eligible home buyers (first home buyers and single parents) to purchase a home sooner.

The HGS includes:

- the First Home Guarantee (FHBG) – to support eligible first home buyers to buy their first home sooner, with a deposit as little as 5%. 35,000 places are available each financial year

- the Regional First Home Buyer Guarantee (RFHBG) – to support eligible regional first home buyers to buy a home in a regional area. From 1 October 2022, 10,000 places are available each financial year to 30 June 2025

- the Family Home Guarantee (FHG) – to support eligible single parents with at least one dependent child to buy a home, with a deposit as little as 2%. 5,000 places are available each financial year to 30 June 2025.

Leveraging your super

The Australian Government also offers the first home super saver (FHSS), which allows people to save money for their first home inside their superannuation fund. Eligible individuals who have made voluntary contributions to super from 1 July 2017 can withdraw up to $50,000 of contributions (capped at $15,000 from each financial year of participation), to put towards their deposit. For more detailed information see here.

Final thoughts

If you’d like personalised help to get your foot on the property ladder, don’t hesitate to reach out – I’d love to have a chat about your plans (no charge!). You can either send me a note or you can book directly into my diary.

How are you going about saving your deposit for a home loan? Leave a comment below to let me know if you’re planning to use (or already have used) one of the options above to buy a property – I’d love to hear your experience.