By Alexandra Olsen | PUNCHY

The overhaul of short-term rental accommodation

Pre-2000s, the term ‘bed and breakfast’ was synonymous with homely establishments run by retirees fond of a yarn and handy with a frypan. Fast forward to 2012 when Airbnb hit Australia soil, sparking a reinvigoration of the humble B&B, and overhauling both the travel and property investment landscapes.

But what’s it really like to run a short-term rental, and compared to traditional long-term tenancies, what’s the investment potential?

For consumers, short-term rentals can deliver in spades on both value and choice. Speaking as Head of Travel & Event Management (wife, mother of 3), Airbnb is a family friendly go-to, particularly for stopovers. Comparatively, a motel stopover could get you a single room with patchy brown carpet that’s seen a few things. Throw in some blue curtains and timber-laminate-everything – and take my money, now! On the other hand, through Airbnb you’ll find beach bungalows, farm stays, and coastal mansions with room to party relax. Not to mention: fully equipped kitchens, spacious yards, and homemade scones on arrival (if you book the right place).

Yes, you’ll discover quirks with most Airbnbs that you wouldn’t encounter at the Four Seasons. But for the convenience, price, and unique setups, (hinterland treehouse or underground outback stay, anyone?) Airbnbs are certainly worth a look-in.

Short-term rentals: great for travellers, what about investors?

So short-term rentals are great for travellers, but what about investors? If you’re investing in property to boost your income, how do short-term rentals perform financially compared to traditional long-term tenancies?

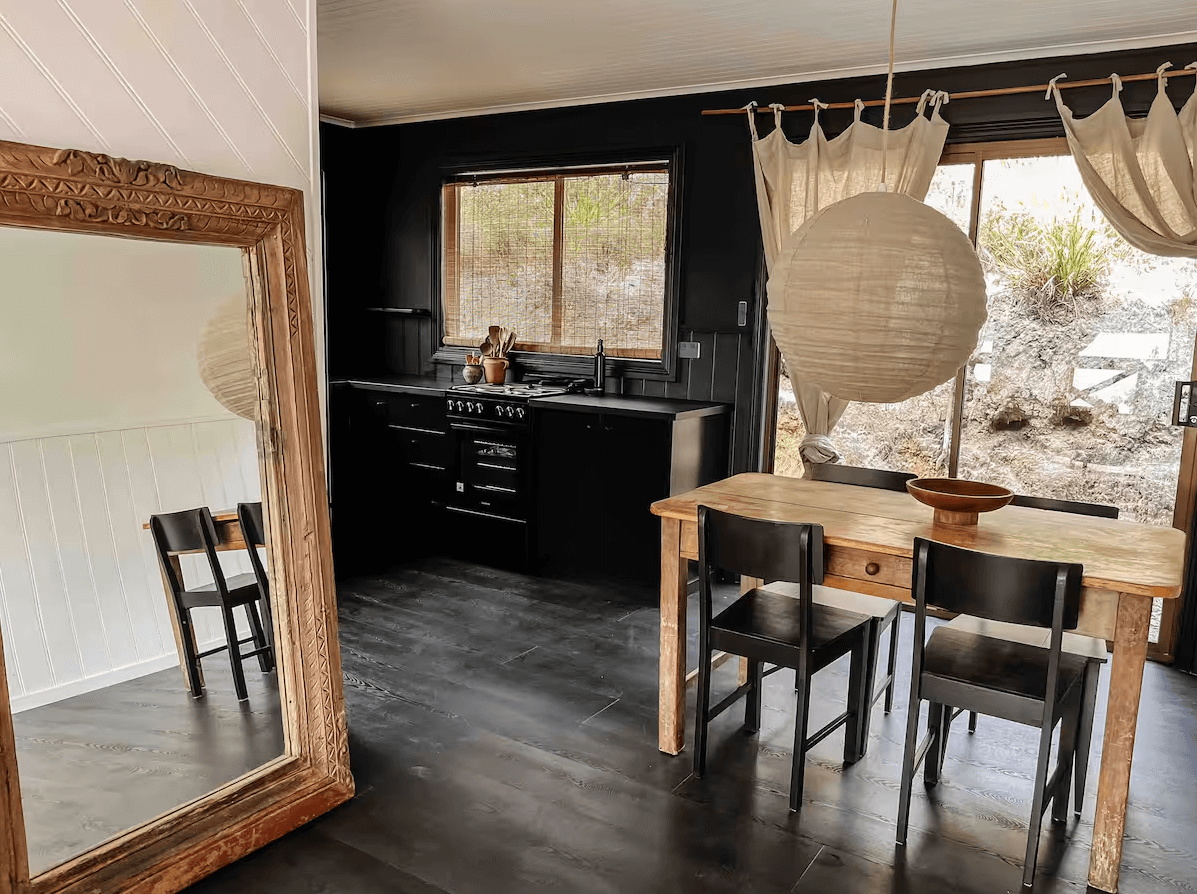

Airbnb’s presence within the travel market has inspired budding hoteliers to refurbish shacks into Shang-gri-las. The goal? Turning investment properties into successful businesses that bring in more bucks than long-term tenants.

Dani and Ryan Tiene run The Tide, an apartment connected to their family home in Pottsville, Northern NSW. Leasing their granny flat as a short-term rental brings some extra income and works perfectly for their lifestyle.

Dani says, ‘I love the flexibility of it all. It suits me perfectly with the nature of my husband’s (FIFO) job and having young kids. We thought about renting out the granny flat, but I can make more money being an Airbnb host. It helps pay the mortgage, I don’t have to travel for work, and I really enjoy it. We often use the space for our extended family visiting from interstate. We also sometimes let out our main house when we’re travelling, which basically pays for our flights.’

Running multiple Airbnb investments

Craig and Eden Hill own 3 Airbnbs including Caba Cottage, Mr BlackGordon, and Senja Village (Bali). The duo drew on their hospitality experience within the luxury super yacht industry and a private island in the Seychelles. In designing properties to attract customers, Craig says, ‘We try to find that one point of difference that each property has, and then create the space around it’.

As far as the logistics of managing multiple short-term rentals goes, ‘The biggest challenge would be managing the properties from a distance. It’s critical to find good management, or someone you can rely on to look after your property as if it were their own… that can be a challenge’.

In terms of the investment, the husband and wife team advise, ‘It can be very rewarding and profitable. Just make sure to do your research on location and pricing of your asset, and make sure you don’t overcapitalise’.

Working as an Airbnb property manager

You don’t have to own a property to earn an income through Airbnb. Property host Simone Millar is the perfect example. Simone is self-employed and works as a host on behalf of Airbnb owners, charging a commission per stay.

On her experience as a host, Simone says, ‘Airbnb, for me, is very user-friendly. Admittedly the trickiest part is keeping your listing “alive” and competitive. Because there’s an oversupply, each property needs a unique reason for tenants to book’.

On considering a short-term rental versus long-term tenants Simone says, ‘If income is important to you, you may want to consider a permanent rental for guaranteed income. Airbnb is great for those wanting access to their property for themselves or family. There are peaks and troughs, and you would need to be okay financially to weather the lows. The low period is generally a good time to get things done like deep cleans, air-con services, painting, updating furnishings, and those types of jobs.’

How to evaluate potential Airbnb investments – which properties are likely to do well?

So, you’re considering entering the short-term rental space… how do you know if it’s going to be a good investment?

When you buy a property to rent out as an investment, you can go the traditional route of long-term leasing, where your tenants sign a lease for a minimum period of time, usually a year, or short-term leasing – aka Airbnb, and the like.

If you’re considering running a short-term rental there’s a lot to consider. The rental yield is probably near the top of your list.

According to Airbnb itself, ‘the average profit for a short-term rental property varies widely based on location, occupancy rates, and management costs. On average, a well-managed property can expect to earn 20% to 30% more than a long-term rental’.

You’ll want to do some deep research before buying with the idea to host a short-term rental. The best performers are located in popular travel destinations for holidays or work. They’re also close to amenities, and attract customers through unique features. Location will do the heavy lifting. Buyers need to do their homework to determine the rental income potential. They also need to have a clear idea of upfront set-up costs, plus monthly and annual costs. Ongoing costs include maintenance, cleaning, taxes, levies, and possibly a property manager.

When investing in property, you want to base your decision on long-term growth and profitability – not be lured by the ‘glamour’.

The pros and cons of Airbnb investments

Pros of running an Airbnb:

- Higher income (though not guaranteed)

- You can still use your own property

- You don’t have to deal with long-term undesirable tenants

- Business ownership opportunities

Cons of running an Airbnb:

- Higher upfront costs

- Cash flow uncertainty

- Higher maintenance costs

- Higher running costs

The main pros of Airbnb investments include the possibility of higher income; the fact that you have the option to use your own property; and that you’re not locked into (possibly undesirable) tenants. Bad tenants can be a real pain when said tenants are locked into a 12-month lease.

As for the downsides, opting to run a short-term rental means higher upfront costs, cash flow uncertainly, higher maintenance costs, and higher running costs.

If you’re hosting short-term visitors, you’ll need to pay upfront to furnish and decorate your short-term rental. You’ll also need to supply all the creature comforts. If you want to be competitive, you’ll need to put in some effort, and dollars, to stand out amongst your competitors.

Costs to maintain a short-term rental are higher compared to a long-term rental, as guests expect properties to be maintained to hotel standards. Running costs will also be steeper, and of course, owners have to foot the bit for all utilities. Insurance costs higher, too.

Airbnb levies and restrictions in Australia

Buyers should be aware that States and Territories have introduced levies for short-term rental owners in a bid to combat the shortage on long-term rental properties in Australia. All these considerations need to be factored in.

Notably, the Byron Shire Council has recently introduced a 60-days per year restriction on short-term rentals where the host doesn’t also stay on the premises (termed ‘non-hosted short-term rental accommodation’). The restrictions are largely aimed at addressing an undersupply of housing across the area. Government policy at all levels has the potential to disrupt the viability of short-term rentals. Go in with your blinkers on.

Using a property manager to run your Airbnb investments

Running an Airbnb can be time consuming. Whilst some short-term rental property owners fully manage every aspect of their Airbnb properties, many owners outsource to property managers. This model is especially useful if your investment can be lucrative as a short-term rental but you don’t have the time to personally manage it. Property managers are essential if your investment is in a different location to where you live.

Enlisting a property manager doesn’t necessarily need to hurt your income, though. MadeComfy is an Airbnb management company who claims they consistency deliver 20% to 40% higher returns to its property owners than equivalent Airbnb listings.

A pivotal yet often overlooked strategy in Airbnb hosting is dynamic pricing. Unlike static pricing, dynamic pricing adjusts nightly rates in real time based on local demand, seasonality, events, and competitor activity. Implementing tools like PriceLabs or Wheelhouse can lead to a 20–40% increase in annual revenue. These platforms analyse market trends and automate price adjustments, ensuring your property stays competitively priced to attract more bookings. Hauz Management comments, ‘We’ve seen firsthand how dynamic pricing significantly boosts profitability, especially in high-demand regions like the Tweed and Gold Coast’.

How do Airbnb investments compare to long-term rental investments?

At the end of the day, short-term rentals require more cash input and more responsibilities than long-term rentals, but they can bring overall higher profits than long-term rentals.

Key word: can – not will.

You can charge more per night for an Airbnb stay compared with long-term renting, but it’s the overall occupancy rate of the property that will determine whether your income will be superior with short-term or long-term tenants.

Investors need to be savvy about determining the likely occupancy rates where they intend to invest.

When asked for their perspective on Airbnb as an investment strategy, The Property Couch podcast hosts explained, ‘It is not a passive investment – the cleaning, the maintenance, the parties, the noise complaints – all of those things need to be considered’.

The hosts, both expert property investors, emphasise making sure your investment itself is a sound one that will grow. They add, ‘It makes sense for some people. If I’ve got a holiday house that I’m not using, that’s going to add to cashflow.’ Their advice is to invest in property that has owner/occupier appeal, scarcity, and is ‘investment graded’ – and if it also stacks up as being suitable for an Airbnb investment – bonus.

How do you get a home loan for Airbnb investments?

What do you need to know about borrowing money to fund a short-term rental property purchase? Mortgage broker, Lindsay Olsen, explains, ‘Even if your intent is to lease out a property as a short-term rental, banks will only look at the potential income for a long-term rental, to work out how much money you can borrow’.

‘Once you’ve been leasing out a property as a short-term rental for 2 years and the property is bringing in a stronger rental return than if it had been on the long-term rental market, then you could refinance, meaning, replace your old mortgage with a new mortgage. The new mortgage will factor in your actual, higher, rental return. Your higher income would mean that you’d now be eligible to borrow more money from a lender, meaning that you could potentially invest in another property.’

Investment loans can get complicated, so Lindsay advises, ‘If you’re thinking about investing in property, and particularly if you’re interested in how things will look for you if you intend to lease the property as a short-term rental, always seek out an investment-savvy real estate agent and mortgage broker who can help tailor your investments for long-term success’.

There’s no question that short-term rentals are popular amongst travellers, and depending on your circumstances and goals, Airbnb investments bring the possibility of great earning potential and side-hustle satisfaction. Key takeaway: plan your investment before you plan your brekkie baskets.